Hi Alexandra, thank you again for the work put in this.

Gambling ones livelihood away does not seem like a good idea to me either, although that choice of words is a bit too dramatic for what I was thinking.

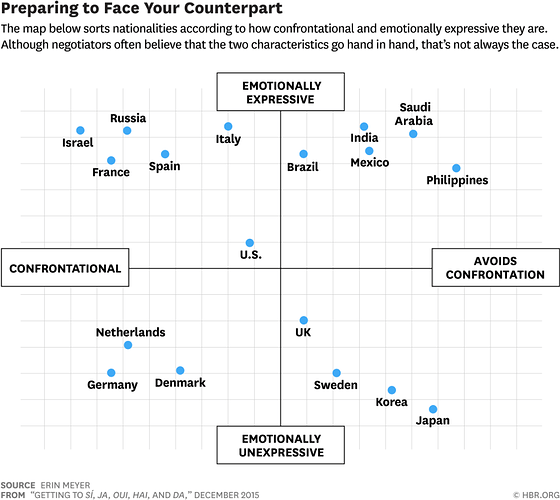

I’m from the Netherlands (that country that invented the stock market). The following graph may help translate the intention of my words.

We have a good social system in the Netherlands. Compared to the US, low and medium wages are higher, and high wages are lower. The government calculated that “a livelihood” for a family of 3 is € 1,525 ($ 1,725) per month. When I see an average management position budgetted for ~$4,150 ($50,000/yr), I hardly think that paying $2,075 in fiat - and another $2,075 (x1.5? x3?, x10?) as a delayed smart contract bonus quite literally attached to how well the team performs - is synonymous for bargaining/gambling ones livelihood. In a way it’s similar to ISOs and NSOs or time delayed incentive plans.

In fact, imagine a mandatory incentive XEM pay of 25%, there could be a secondary tax incentive for the incentive plan. Ask anyone - managers to hired hands - if they are interested in increasing the percentage of XEM pay to any amount between 25% and 75%, and they would only have to either pay tax over the difference between the grant date and the exercise date or consider the spread as taxable income, you might be surprised. It might be worth looking into the possibilities. Or not. Just want to point out the sincerity of the idea.

Although only slightly related, I would also like to point out the holding incentive plan (not for employees but for customers) of the (formerly Monaco) crypto dot com MCO holders. They need MCO at a steady price during the marketing period of their visa cards, so they are distributing CRO airdrops for MCO holders. You see them accumulate in the crypto dot com wallet. However, they are locked for 12 months, and only valid for the percentage of your original amount of MCO that you are still holding 12 months after the airdrop. This way you are free to spend, but incentivized to hold.

If the proposal is rejected, what does that mean effectively for future activity and money burn rate? For example, if the proposal is rejected, does that mean that no money is allowed to be spent until a proposal is accepted? Does it mean no one can be hired? Is there a limited number of operations that continue, analogous to a US government shutdown? Or is the vote just a formality?

Edit: Changed “.com” to “dot com” so it won’t unintentionally be considered spam.