"What kind of interest are you paying them when you’re not making any though"

Unless all crypto markets go bust, or there is some cataclysmic event, we will continue making margin loans. This is a demanding market which we don’t expect to saturate for quite some time. In fact, trends show the demand for margin loans is increasing.

"So this company will obtain license for each country you operated in"

Yes. Every country we operate in, we will make sure we are legally compliant. - However, blockchain is international for anyone to use, regardless of which countries we choose to operate in.

This means anyone anywhere can use it, except in these unlikely events:

A. Our base country (USA) forbids servicing citizens/residents of a specific country.

B. The country which the user is located bans their citizens/residents from using myCoinvest. - And even then, it is up to the user whether they continue using myCoinvest or not.

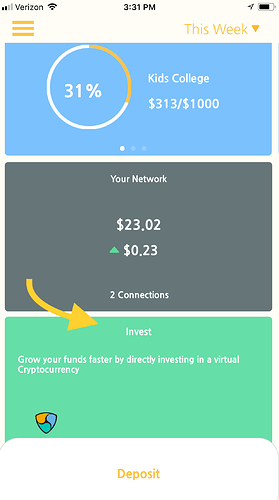

This question brings up a very powerful use case. - Banking the unbanked.

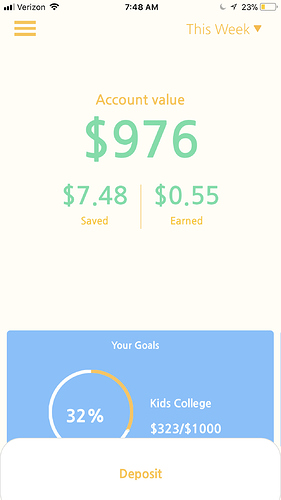

If a person is otherwise able to get money into crypto, they can deposit it to their SMART wallet, sell it for USD or other acceptable fiat, set a savings goal, and effectively have a high yield savings account held in whichever currency they chose. - Of which they can withdraw, or send to someone else, whenever they like.

There really is no feasible way for governments to stop anyone from doing so.

"are these lending contracts something to be performed on the NEM blockchain"

Like keelo mentioned. Our own internal exchange will allow margin lending - which will be fully transparent on the NEM blockchain. Right now, there is no way to add true 24/7 transparency to margin loans on external exchanges, However the transactions to and from exchanges will be visible in the blockchain. Additionally, all lending activities will be recorded and auditable as well, though this data is not stored on blockchain since it occurs within the exchange.

One last thing - The great thing about margin lending, is it is always backed by collateral, which is digitally locked, so there is virtually no risk of failure to receive repayment.