VOTE CLOSED

Poll address for voting via nano wallet voting center:

NB7FSOGQV5NF5PM7RWW26LFNHISHDOWY5MDHCZF4

Alternatively,

To vote yes, send a 0 xem transaction to the account:

NAOPM76SSNMZQSVRV7E3AOYNYROB54MGNDYWYRNM

To vote no send a 0 xem transaction to the account:

NDOHPA2BOTP6B4P6GPSOXNYH7RK3QSM6SL4WB3WG

The vote is PoI based and will run until 18:00 on the 07/09/2018 (GTM)

We would also like to take this opportunity to address the primary concerns: experience, spend and who holds the investment funding money.

Experience & Potential Partners/Advisors Disclosure

We have taken steps to prove the experience in corporate finance and equity & debt markets, as well as analyst work, of David Mansell. These references (including one from a current VC fund director, and the former Director of Project Finance for HSBC) have been shared and verified with members of the Nem community.

Further we can now name two of the interested parties who will act as advisors/partners in Ventures –

• David Shaw, currently managing a private equity firm and was Chief Commercial Officer for Cable and Wireless Europe, Asia and the US before taking the role of CEO of Cable and Wireless Caribbean, leaving the business in 2012. David has a wealth of investment experience, in equity capital markets, and board governance across multiple jurisdictions.

https://www.computerweekly.com/news/2240082761/Vodafone-signs-40m-deal-with-Cable-Wireless

• Iain Wilson, who spent 15 years as Managing Director of the HSBC fixed Income Trading desk, before a further 4 years at BNP Paribas. He currently provides strategic advice, investment analysis and execution strategies related to asset and liability management. He is an active angle investor, operates as an advisor to tech start up businesses, and is the portfolio manager for interest rate, credit and equity portfolios of up to $26bn USD. https://www.linkedin.com/in/iain-wilson

We trust that the experience of the team allays any fears about whether the team is equipped with the skill set to deliver. Vote yes to help us create a well governed, professional fund that helps businesses deliver for the benefit of nem.

Expenditure

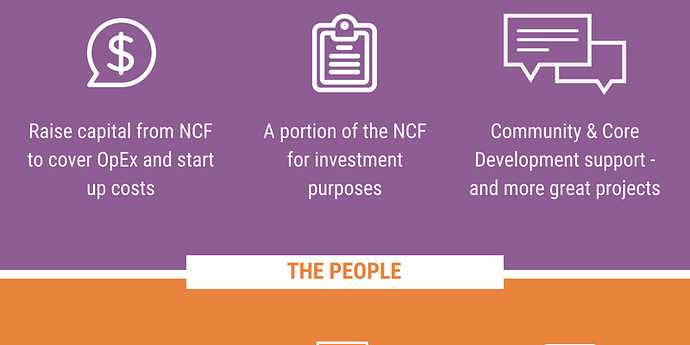

There seems to have been some confusion around the figures that have been requested. After start up costs are deducted, spend is on due diligence investigation on the proposals (necessary to ensure we select legitimate and the correct projects), and audit costs for which we have opened conversation with Ernst and Young. Partners retainer fees are nominal as the partners are committed to and believe in nem and the project and will have vesting.

As a guide, around half of the operating budget is expected to be used to cover retainers for 5x partners, 1x analyst, 1x admin and 1-2x advisors. We hope this illustrates the commitment the founding members of the team have in the project.

Authority Over Management and Funding

Funds and management will not be controlled by ventures, but by the trust and its co-signatories.

Current Issues Highlighted by Core Developers

As mentioned by Jaguar and Gimer, the current issues with backlog, lack of resources or proper vetting of proposals, lack of sustainability of funds and sensible evaluation of company performance for release of funds.

Outlook

Failure to incorporate given the current position will mean the possibility of this finite resource ceasing to exist. This solution will provide a sustainable position for the fund, while bridging the gap between nem and the more traditional financial world. Further it will make nem blockchain more mainstream and therefore improve trust and increase interest.

Notable Articles

History and Context

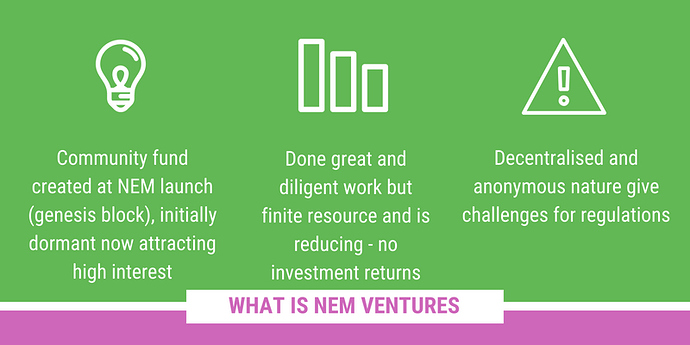

The NEM Community Fund (NCF) has existed since NEM’s Genesis Block. It is a reserved pool of tokens which are distributed to help fund projects that benefit the NEM ecosystem and uptake in general. The pool of tokens is a finite resource and managed by a committee drawn from the community.

The NCF work to date has been fantastic, this proposal does not detract from that in anyway, it seeks to build on it with a natural progression to ensure it can continue well into the future.

Current Challenges

Initially the fund lay near dormant, but with the growth of NEM, interest in the fund has grown to the point that it is harder to manage and funding request sizes have increased to a point that this finite resource is beginning to dwindle as there is no plan in place currently to replenish the fund; 2018 currency volatility has compounded this problem.

The funds decentralised & anonymous nature, gives projects legal challenges under financial regulations and could be improved upon - in terms of sustainability, reach and efficiency and ultimately effectiveness.

The Solution

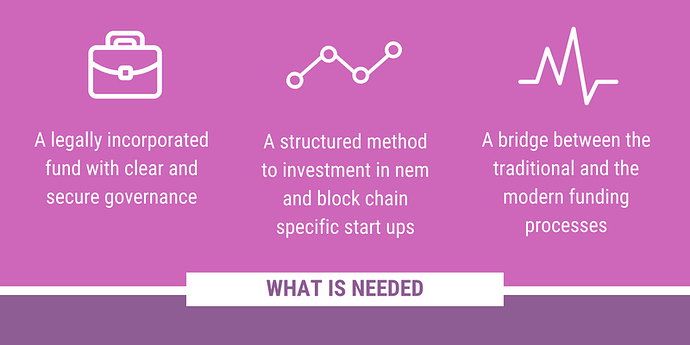

Form a legal entity around the fund which formalises it once for all projects, and create an investment entity which can receive positive returns from investments to ensure the fund is replenished and managed for the good of the NEM community and the projects.

This also allows for an expansion into new areas which will benefit the NEM ecosystem beyond providing seed funding and can be used to fund non-profit initiatives.

NEM Ventures is an important addition to the Nem ecosystem in order to remain competitive with other platforms who already have these entities in place.

I brought Dave Hodgson & David Mansell in to co-write a proposal for a new business model that will ensure clear, transparent and secure governance remain in place in years to come and allow for expansion of the scope of initiatives.

How Will this Work?

-

NEM Community Fund Trust (NCF) with long standing NEM community members as trustees, will manage all of the NCF funds under a legal Trust like entity

-

NEM Ventures - a Crypto Equity/Capital company that focuses on early stage projects that are aligned with NEM and can be commercialised facilitating profit return to the NCF Trust.

-

NEM Not For Profit Trust (NFP) - a trust that is part funded by the above two entities and part by profitable projects that have been invested in, to manage Grants, Scholarships, Research Funding and Blockchain hub propagation

What Happens Next?

NEM Ventures will take over the processing of any proposals not yet passed community voting rather than processing by public vote and committee review and will apply appropriate KYC and Due Diligence to this process with a view to taking equity positions in the projects and providing expertise, and VC links from our existing networks to help companies achieve their potential and ultimately profitable exists for NEM Ventures.

The NCF committee will process existing proposals already passed community vote as the old processes are phased out over time, however, NEM Ventures will be on standby should the committee require input into milestone reviews or other legacy processes.

We are seeking the mandate to:

-

Manage a portion of the NCF with NEM Ventures in accordance with a strict governance, delegated financial authority and tranched funding tied to measurable, clear milestones. Funding to be managed by the Trust below

-

Form a legal entity around the NCF, to be controlled by NEM community trustees, which follows the same approach as now using co-signatories, but is legally incorporated

Given the gravity of the proposal, it is necessary to also put this to community vote as with any other. The proposal is open to public comment for the next 10 days, and shall then proceed to a public vote. Details of the vote will be included in this post the day voting commences.

We hope that over the next 10 days we can garner the support of the community in this new push towards making the NEM platform and the NCF an even greater success.

Main Proposal