Many times you are saying that the forum is not working . Could you please suggest alternatives to get more people involved in this and other threads? Suggestions are appreciated.

In Telegram channels were some discussions, but the big conversation is the Nem Forum, and I believe is the best medium. In telegram you have to scroll and people are talking about different topics.

This proposal has 120 comments and more than 3K views so far. So I wouldn’t say there is a lack of discussion. This is the proposal with more comments so far!

About the lack of the information, this proposal has more than 20 pages, a lot of info was disclosed and discussed with different point of views. Still you guys can ask more info and then decide to vote yes/no regarding the proposal itself.

Thanks

Well there has been a thread for quite some time regarding the closing of the Japan forum (Nem and Minjin), and it has received NIL responses from Nem officials.

How is this forum “working” in that instance?

This has nothing or a lot to do with the proposal depending on how you gauge things.

Maybe there are other options in the pipeline yet I always thought the Japanese community was pretty important.

It is sad when a truck driver from NSW must point out these inconsistencies.

There is also a guy who posted a coding issue 19 hours ago that remains unanswered.

I do not know a lot about coding but if you have work to do then waiting 18+ hours for an indefinite chance of a reply makes it hard to get the job done.

Dan

Hi Matt. Those numbers are completely made up and arbitrary for the purpose of the example. This is stated at the end if the intro paragraph. Of course we could never create a fixed system like that. Each company evaluation if different.

Im sorry about the typo.

Hi kodtycoon,

I can think of several reasons why this does not adequately address my concerns, but the most important are:

- The paragraph actually says “the percentages are made up and give a relative idea” – on my reading this indicates that the values have been developed for the purpose of illustrating how the equity will work, and that they give an idea of how the relative proportions work.

- If the values are not these (or are not indeed indicative), then what can we expect? This presents a problem with transparency.

- The document, and this engagement process is disingenuous, in my view, if it cannot put straight the record on the most fundamental aspects of what it means. What are we moving to? Why? How will it change things? The question of how much equity is central to this.

My vote is no.

Thank @MattRiddle the numbers are relative to each other. Generally speaking the equity percentage will be comensurate with the value the project brings to nem, the valuation of the company vs the investment amount, what pre/post money valuation any earlier rounds have given, whether there is scope to open source the technolog etc.

There are various factors and consistent with how startup funding normally works, they will vary specifically by deal. There is no one size fits all in this approach, anywhere, because there is no one type of business or investment.

Thank you for replying, David. However none of those points really help to clarify what is meant by this section of the proposal. I think my concerns are still valid, and shared by a number of people in the NEM community.

Thanks @xemnewbie, yep we know the forum is less than ideal in terms of activity, its been part of the challenge for the NCF previously. It however what we have right now to work with. We are also active on telegram with multiple groups to try and bring people in to the forum who may not see it rather than rely on organic interest. That includes several non english channels.

With regards to who can point things out and fix them…that is one of the beauties and challenges of a community, if you feel strongly about it you can put forward suggestions for change and run with them. Its exactly how this proposal came about, we are trying to fix a few problems, there several others we have had mentioned as well, but we cant focus on everything. Im sure the community would be open to supporting you reforming forums etc if you want explain it and garner support for it. We are happy to support or act as sounding boards, just cant do everything in one go.

In terms of NEM officials, I assume you mean the foundation, perhaps its worth speaking to the country head out there to see if you can change it. The NCF as stated before is outside the foundation’s mandate explicitly when they were set up.

In response to the surprise, the proposal has been discussed and reviewed with various senior members, you will see Jaguar and Gimer clarified a couple of things earlier in the chain as well. Unfortunately if the forum has poor activity, and telegram isnt in use, its hard to know how to engage in a way that gets to everyone

Your concern was how much equity will be taken in a nutshell, right?

The answer to that is that it depends, because there is no rate card (with NEM ventures or almost any other source of funding) for equity required.

There is no way to answer other than it is on a deal by deal basis and the guiding principles are there to be fair to the investee and pick projects that contribute to NEM positively. To answer any other way would be a lie or naive.

The reports and accounts that go to trustees and community are there for transparency and of the fund is acting in a way that is not desired the trustees as representatives of the community can stop it as the majority owner.

Sorry, I dont think your question has a right answer unless you can state it another way?

If others in the community share the same concern we welcome their input publicly, otherwise its hard to address their specific views as well.

I’ll have another go at stating my concerns, in case it wasn’t clear enough:

- The proposal is not clear on how equity will be dealt with, overall.

- The section of the document that deals with this more specifically is open to interpretation, and my interpretation of it (and that of others apparently) is that it is giving indicative levels of equity, and these levels are alarming to me

- I don’t think there has been nearly enough discussion, and transparency around this discussion, specifically on the issue of what equity expectations there are.

Please understand I am not taking any issue with the use of the forum or anything like that. I don’t think it’s been clearly discussed or spelled out in the proposal, and I think that’s a significant problem that I can’t get past. My vote remains no.

That was an example. It says for a project funded from early stage/concept to completion, ie. NEM is the sole funder. In that case 40% is not terrible. I don’t think it’s a valid reason to reject the proposal either just because you don’t like the terms from an example. Of course no project would accept 40% for 400k if they are not even going to be ready to go to market at the end.

This point initially perplexed me also until I realized that nem would have been funding the entire project in that example. 40% is just ridiculous if you still need to attract other investors. Founders would be left with 10% or less, unless the a round was diluted. Or if you did have a diluting a round, then nem would take 40% and the founders take 60%, then you double the number of shares for the a round and give investors 50% leaving nem with 20 and the founders with 30 or any variation thereof. But this doesn’t fit with the example assumption of fully funding the project from idea through completion.

I don’t think it’s as bad as you feel it is and I’m also applying for funding.

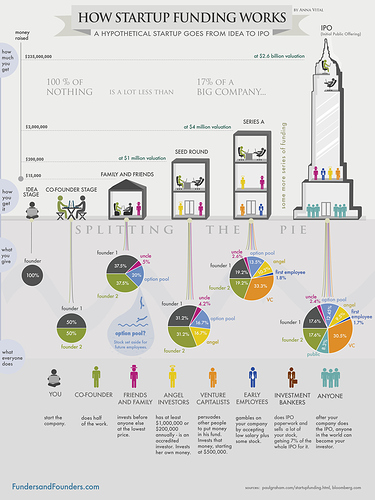

I’d just like to elaborate generally on how funding works for startups for any who may not have experience on this. There are two common types, the traditional kind which values the company being valued at each phase and diluting shares as they go and the more modern version involves distributing convertible notes to be converted into shares at the final raise and putting off a valuation to a later date.

This graphic describes the traditional model very well:

I may be wrong here, but this is what I assume that they were referring to in the proposal because it was written that the startup would be funded from concept to completion leaving the founders with 60% and NEM with 40%, that’s pretty good. In this case the company would be valued at about 800k. If the company decided to go through further funding rounds (IPO, series B etc.) then the shares would be diluted and the the companies valuation reassessed at each stage.

Convertible notes on the other hand are what it would seem to me Matt Riddle is referring to. In this system valuation is put off until a later date. You sell a % of the final valuation to each investor at whatever price is agreeable to both parties at that time, as well as other options for conversion, or interest repayments etc. For any who are interested in convertible notes I recommend reading about SAFE and KISS, these are basically the standard for start-up companies. This is because the standardization, as well as delaying valuation decrease the costs to access funds considerably.

Sounds great, I will be voting yes for sure

Did everyone see this edit to the proposal? There are a few edits, check the top again.

Further we can now name two of the interested parties who will act as advisors/partners in Ventures –

• David Shaw , currently managing a private equity firm and was Chief Commercial Officer for Cable and Wireless Europe, Asia and the US before taking the role of CEO of Cable and Wireless Caribbean , leaving the business in 2012. David has a wealth of investment experience, in equity capital markets, and board governance across multiple jurisdictions.

https://www.computerweekly.com/news/2240082761/Vodafone-signs-40m-deal-with-Cable-Wireless 4

• Iain Wilson , who spent 15 years as Managing Director of the HSBC fixed Income Trading desk , before a further 4 years at BNP Paribas . He currently provides strategic advice, investment analysis and execution strategies related to asset and liability management. He is an active angle investor, operates as an advisor to tech start up businesses, and is the portfolio manager for interest rate, credit and equity portfolios of up to $26bn USD . https://www.linkedin.com/in/iain-wilson 10

The NCF topic can be considered to be a very important one for NEM, its community and its ecosystem. Which is why I would like to thank everybody for reading this forum. After having read all the posts in this topic, all the post in the preceding topic and the entire proposal document I would like to share a few thoughts.

First of all, I tend to focus more on what happens and what people do or don’t, and less to what they write or say. It is easy to give an opinion, it takes more effort to act.

In this case the proposal involves an initial stakeholder that has spent a lot of time in the past years working and dealing with the NCF as volunteer, as probably a lot of others in the NCF Committee have done as well. It deserves appreciation.

Second, there are a number of strategic and operational issues related to continue managing the NCF, as described in the proposal as in some replies above and confirmed by the core devs.

This team has identified the issues and acted accordingly: talked to each other and discussed what to do, consulted the community, took initiative, constructed a team, thought and discussed about options, started writing a proposal and finally had the courage to publish it publicly here. It should be appreciated as well.

Third, there are a lot of details in the proposal that could have turned out differently if other people would have been involved or consulted. To be honest, I was disappointed I was not involved and not even aware, as probably a lot of others were as well. But it should be carefully considered if that should influence a vote on what others are doing or proposing. I was not involved with the NCF in the past and never gave it a lot of thought, my own fault I must admit. But that changed when this proposal was made public here. Thank you.

Lastly, regarding the proposal itself, I can agree with a lot of questions and remarks provided here, I will not repeat them. But things need to change, and this team has described a possible solution and has shown willingness to answer and reply to most requests, even prepared to change the proposal.

It’s in the NEM culture to want to change things and to be positive when that happens, which is why I like the NEM project so much. Negative remarks can be expected with such an important change, but should be put into perspective as well.

So, although the proposal document is not perfect in many aspects, I tend to be willing to support the people who took this initiative. In my opinion they deserve a chance to rectify, correct or improve the project based on all community feedback they receive here.

I couldn’t have said it better myself. Voted yes.

So I have raised my concerns and questions and none was answered.

So obviously I need to say no.

Who decided on the first initial current NCF members ? No one raised issue from NEM foundation that the members are being overwhelmed and only a couple is active?

Why are we not selecting new NCF members with voting rights ?

Only start giving remuneration after certain conditions.

1 being, that the NCF members needs to be active, one can add measures in place for this.

2 being, confirm collaboration and feedback on at least 2 proposals, start to remunerated the NCF members based on that. To properly evaluate a proposal one needs to put in good quality time, so no one can do this constantly for a long period of time as hours can be spend somewhere else that pays you well.

Proposals needs to be managed and packaged in a presentable way to NCF members. Get some professional to do this. They can screen the proposal to ensure mandatory info is there, they can recompile the info for NCF members to revise the proposals.

Those same professional can then manage to compile info collected that indicate how the proposals is doing on a regular based. They can manage the backlog as well, prioritize serious ones from not so serious ones.

If the professional present poor quality of works, then community kicks them out and we select new ones.

We have a massive community, has anyone asked who is willing to do this. I am sure that we can easily get about 5-20 people willing to give up some time to start putting this all in place and we could vet their credentials. When most of the governance and process is in place, they can show to community what they have done and then the community can decide if the POC is a good idea and then select these individuals to manage the process.

We do not need all the legal stuff to happens. Adding too many legal avenue only creates a back door for bureaucracy, which will lead to legal battles, which could freeze this fund indefinitely until legal battles are done.

1 Who can give power to the NCF members, and who decided who is going to be NCFm’. If we can identify and speed/improve this up, then we will always have NCFm’ to vote.

2 If we have a group to prepare the proposals as suggested above and manage the information feedback to community, then the NCFm’ time would be freed up a lot.

Just for example. I am quite busy, but from time to time I could review proposals if there was structure to it and if I knew about it.

I have about 9 years banking experience, 2 years financial planning experience and 5 years IT experience. I have some better idea than the average joe about financing, investing, process management, governance, business processes etc and I want to make myself available where I can, but there is no easy place to indicate this to NEM and the community, it seems that only founding members or selected individuals at the start have say and play in the governance of NEM etc.

Lets open forums to ask who wants to be NCF members. Let see their credentials and ask to why and who want to manage the proposal process, let see if there is any interest.

To Nem Ventures, I still do not understand that you had the time and opportunity to highlight the process/governance that you would take on a proposal and did not do so as of yet.

Why have you not taken just one proposal that is in the backlog, indicated to us how you would approach this proposal. Your evaluation process, your governance process, your recommendation and how you would manage the proposal going forward if successful.

If you did this, it would have indicated you’re true urgency in this matter and if your above steps were presented in a professional business manner with logical and rational in dept thinking , then surely you would have easily won over most of us asking the hard questions.

Sorry @DaveH, @kodtycoon & @Bwanamakubwa - I hope you can appreciate I’ve come at this with an open mind. I’ve provided constructive feedback and have been open to being convinced, but I’m voting NO.

Why am I voting NO? I have 10 reasons:

-

You’re killing the DAO and taking the public good into private hands.

-

Rushed proposal, not adhering to guidelines other proposals had to go to. E.g. No video, no Japanese translation (effectively excluding that group). Not enough time to discuss. No opportunity to provide alternatives.

-

Lack of transparency - A proposal like this cannot keep anything behind closed doors, like salary and legal contracts. Yearly high-level audit is not enough. We need FULL transparency. Why? Due to the nature of this proposal. If all you were asking for was 850k then that would not be necessary, but you’re also asking for $10m community funds and replacing the existing process, which is why this additional transparency is needed. I would much rather see the ~600k USD in salaries you propose to be spent incentivising the community, paid in XEM. This would spread XEM widely and increase adoption.. Also, as mentioned, there is not enough clarity on the process of how you will take equity. How about some more examples? The example you have provided is not detailed enough, not appealing and not in line with your “Friendly VC” messaging. I’m also concerned by the level of involvement and board seats you’re expecting to take.

-

Lack of community involvement in solution. Sorry to @kodtycoon who had a go, but we need massive involvement - engage across many channels to tease out contributors. This has been said many times.

-

Not all comments have had an answer and there’s been particularly poor attendance from @Bwanamakubwa in addressing community concerns. A lot of feedback from the community has fallen on deaf ears.

-

Self-nomination to the job openings. This is a massive conflict of interest. I would feel more comfortable if you proposed a model, then we did a global recruitment round to fill the talent.

-

You’re proposing a mechanism that removes community involvement from the NEM proposal onboarding ecosystem, instead of fostering it. We want many avenues for the community to stay engaged.

-

You’re not providing an exit strategy or how we vote you out. The DAO will never return, even if you fail.

-

Missing official endorsement and Authority from NEM foundation members and other leadership roles. I’m still not clear how you got the authority to even propose this - Can any Joe Blogs do this? If so, are you saying I can create a proposal for the next 10m?

-

Elephant in the room, the nasty exchange between @MuleChain and yourselves has left a bitter taste to this proposal. That does not seem fully cleared up and does put some doubt into the intentions of the people behind this proposal.

Finally, I want to add that had I known about the issues in the NCF I would have participated in finding a solution. I think many people would have. I thrive in solving problems like this. As Dave said:

I have started writing up a high-level alternative, I’m calling it DAO V2 which I think would sit much better with the community, but I’m saddened as due to time pressure it’s impossible to create a comparable proposal before time runs out. So: Remember folks, there exists an alternative to status quo. NO means NO to centralised NEM Ventures, but it also means we revamp the current process, NOT continue with Status quo!

You had discussions in private, yet omitted responses to your points in this public post. There is overwhelming evidence for the need of VC structure with orderly and specific chain of command. There is little evidence that supports your ideals.

The proposal wasn’t rushed. There has been dialogue for months. And even when final draft was posted, there remained 20 days to review before voting.

You propose addressing the lack of community involvement by relying on it even more than before. A key issue is that community doesn’t do the work necessary. I don’t blame them, it is a lot of work. NCF is always on the lookout for qualified volunteers, but as I’ve said before, 99% go inactive and aren’t interested in putting forth the effort.

Where is all this feedback that hasn’t been addressed?

By your logic, proposing CarbonClick while being the self nominated president would also be a conflict of interest.

Foundation is separate entity from NCF.

Elephant in the room is as big or small as you want to make it. I’ve chosen to not to further address some of the slander. This is actually an example of how community involvement can have negative influence. Did you do due diligence before forming your judgments?

Lastly, if you are a big de-centralist, especially as it pertains to investment - ICO is for you. What better model would satisfy your ideals?

@CarbonClick: thank you for this post.

I also came into this with an open mind, and as would be apparent from the above discussion I share many of your concerns, and look forward to a DAO V2 proposal. I certainly agree it’s a good idea to rethink how the NCF works but am particularly worried about the lack of transparency and rushed feeling of this proposal, and the sense that the proposing self-nominated group will be coalesced as a very strong central authority without proper oversight. There is a strong potential for things to go very wrong.

Voting No.

Exactly my concerns as well.