1. EXECUTIVE SUMMARY

EPC Blockchain Sdn Bhd intends to engage with the energy industry at large to create an energy blockchain consortium consisting of energy service providers, utility companies, Government agencies, financial institutions and facilities management companies. The energy blockchain will serve as a ledger for the energy generation, energy use, energy reduction and avoided CO2 emission for any electrical equipment that is managed by an intelligent energy management system in industry, building or home.

“In the new world, it is not the big fish which eats the small fish, it’s the fast fish that eats the slow fish.”

Klaus Schwab Founder and Executive Chairman, World Economic Forum

EPC Blockchain Sdn Bhd has developed the middleware APIs, launched, tested and can demonstrate the live push of energy data to the blockchain. Further funding is required to position EPC Blockchain Sdn Bhd for strategic partnerships and collaborations with carbon market promoters, traders and governments as part of community expansion and sharing of big data analytics.

BESC’s strategy is to cover the global market, starting with Malaysia where a patent is pending to protect the venture. The business was started, the product tested, and the service launched in Malaysia where multiple tax incentives are available for startup funding.

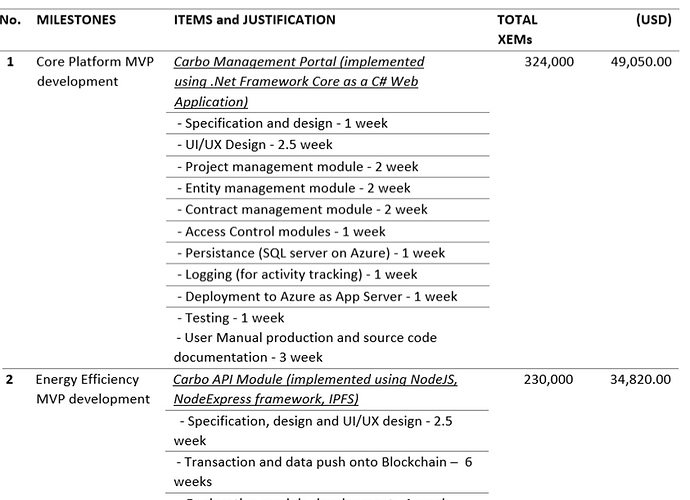

EPC Blockchain is seeking a funding of 1,220,000 XEMs or $184,695 USD to undertake additional system development on the middleware, creation of cloud infrastructure and the private permissioned blockchain network.

A breakdown of the fund utilization is at the Milestones and Timeline section below.

2. COMPANY BACKGROUND

EPC Blockchain Sdn Bhd was founded by experienced professionals in the energy industry who have implemented a range of energy saving and renewable energy projects in Malaysia. Taking heed of the challenges faced by energy professionals in the implementation of energy projects, the founders sought a robust and secure way of managing energy data to quantify the benefits and securitize payments for projects.

EPC Blockchain Sdn Bhd shall develop and manage the Blockchain Energy Savings Consortium (BESC) where BESC is intended to be a ledger for the energy generation, energy use, energy reduction and avoided CO2 emission for any electrical equipment that is managed by an intelligent energy management system in industry, building or home.

BESC shall provide the necessary Application Programming Interface (API) to allow the easy integration of energy data from the various energy monitoring system vendors into the blockchain to securitize the energy data while reducing individual facility server costs. When the data is on the blockchain, facility owners can potentially monetize peer to peer and certified carbon credits which they once could not and in the future gain insights in to the performance and predict failures of their equipment.

BESC will also provide project developers with business continuity since the use of blockchain technology ensures data storage reliability which is the basis to justify claims and payments.

An unrivalled benefit of BESC is the ability of project developers to raise the necessary capital to implement projects through equity crowd funding platforms. Investments into energy projects which were once only accessible by large institutional investors is now open to the public. EPC Blockchain calls this “Empowering the masses to mitigate climate change” BESC is beyond just a platform but intends to become an ecosystem to spur the creation and development of sustainable and equitable energy projects to save energy or generate new energy.

3. BUSINESS OVERVIEW & GROWTH STRATEGIES

Carbon savings through energy savings

Energy savings or generation of energy through renewable means abates climate change through the reduction in CO2 emissions. The use of blockchain to track, monitor and record such initiatives in a decentralized and encrypted/secure manner provides an avenue for a well-documented and traceable CO2 emissions certificate generation in line with the methodologies prescribed by the United Nations Framework for Climate Change Convention (UNFCCC). Such climate change mitigation actions are critical to the sustainable development of the world and are in line with the United Nations Sustainable Development Goals.

EPC Blockchain Sdn Bhd intends to use a blockchain to track and record the energy savings. The blockchain will convert the energy savings to an internally generated Energy Savings Token (ES token) on the blockchain system to represent the amount of savings achieved (in kWh) and repayments due to the respective parties in the Energy Performance Contract (EPC). Such tokens would subsequently be deposited into the contracting party’s digital wallets and monthly settlements would be based on the quantum of ES tokens in each party’s wallet. ES tokens will be generated automatically based on energy savings measured from calibrated digital power meters. This provides credibility to the data and reduces the risk of uncertified energy savings.

The ES token is pegged and backed to a local currency through the EPC legal documents of the respective parties. This provides stability to the settlement of monthly invoices. ES tokens can be purchased by depositing fiat and is destroyed when the energy service company (ESCO) redeems ES token for fiat currency.

In parallel with ES tokens, EPC tokens will also be generated. The EPC token is a token that is generated based on a country specific calculation of the amount of CO2 abated generated from each unit of energy savings. These tokens will be generated in compliance and adherence to the requirements of the certified carbon emissions methodologies prescribed by the UNFCCC.

It is intended that the EPC token be made equivalent to an amount of CO2 abated. The EPC token will be listed on crypto-currency exchangers which can subsequently be purchased by any party. EPC Blockchain Sdn Bhd will make a fee through the provision of the blockchain services to record energy savings. Asset owners and ESCOs will pay in EPC tokens for the use of this blockchain which we shall refer to as the Blockchain Energy Savings Consortium (BESC).

Software as a service for energy performance record keeping

In this model, BESC will be used as a ledger to document energy savings transactions. Payments between parties (building owner, ESCO, and EPC Blockchain Sdn Bhd) will be settled in fiat currency as per a conventional contract. The amount of fiat currency to be paid shall be documented in the energy performance contract legal document, measured and recorded in a new and internal only generated coin called the “Energy Saving (ES) token.” Each party’s wallet will be apportioned ES tokens when generated from the energy saving project. Fiat currency payments shall be made in accordance to the amount of ES tokens available in each party’s wallet against an agreed fiat currency exchange rate for each ES token.

The blockchain will also generate an EPC token which shall be shared between the parties. EPC Blockchain Sdn Bhd will be apportioned a percentage of the ES token and EPC token as a fee to record the transaction into the blockchain. EPC Blockchain Sdn Bhd intends to use the NEM blockchain and therefore requires XEM coins to record the transaction on to the blockchain. This XEM fee shall be borne by EPC Blockchain Sdn Bhd. EPC Blockchain Sdn Bhd will recoup this cost through a commission from the payment of fiat currency for the energy savings (ES token) payments achieved by the ESCO from the building owner.

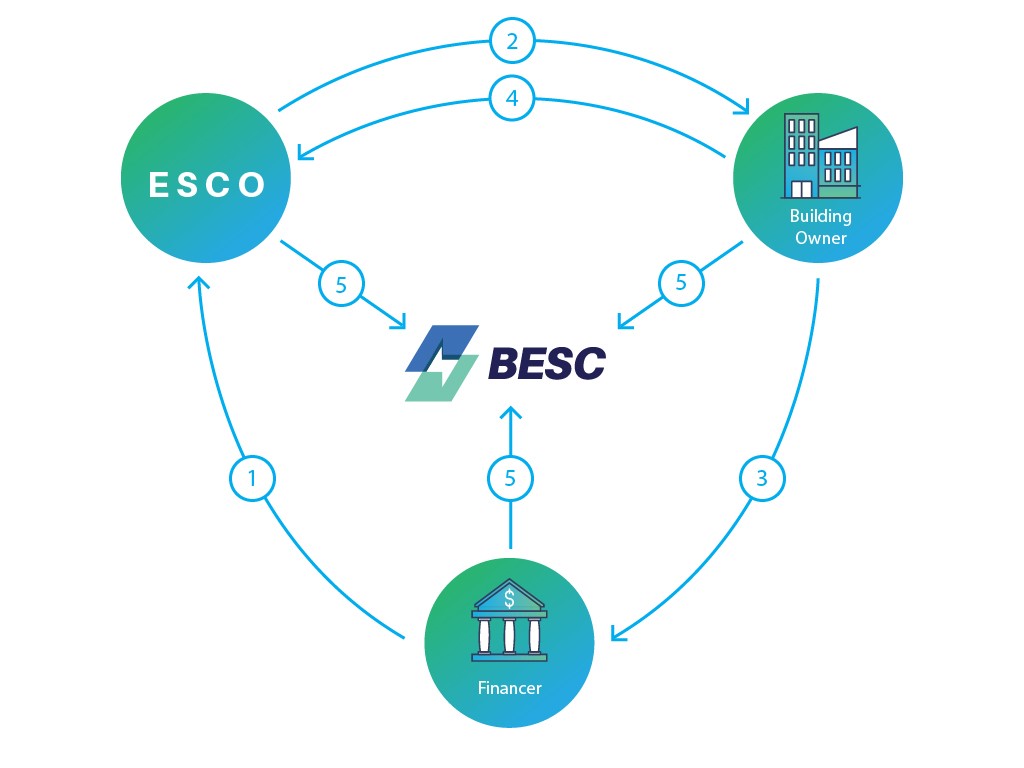

- Financer provides the necessary capital to the ESCO for equipment purchase

- ESCO uses the capital provided by the financer to purchase the equipment for use by the building owner

- Building owner makes payments from the reduced operational expenditure firstly to the financer

- Building owner makes any additional payments required to the ESCO

- All parties pays a subscription fee for the use of the energy blockchain

Payment supporting documentation are set up using smart contracts and blockchain technology, making this the ideal system for transparent and verifiable transferring funds between the client and the service provider, and guaranteeing that payment will be transferred only when the energy savings has been achieved. Using a decentralized payment system and smart contracts, BESC can be used to monitor and track anticipated versus actual energy savings from the start to the end of the Energy Performance Contract (EPC). Smart contracts allow you to generate business intelligence dashboards promoting the principle of transparency and security of financial transactions.

EPC token monetization

EPC tokens will be collected by EPC Blockchain Sdn Bhd. With scale, the amount of verifiable EPC tokens aggregated from the various energy performance contracts can be sold to any interested third party on a voluntary basis. The use of blockchain provides the transparency to ensure the quality of the carbon emission reduction. The recording of the carbon emission on the blockchain provides purchasers with the security that the carbon emission cannot be duplicated or falsified.

It is anticipated that energy saving projects implemented under the energy performance contracting modality meet the Clean Development Mechanism methodology and demonstrates additionality to ensure the legitimacy of the environmental stewardship claims.

A problem that has plagued digital currencies since their inception is price volatility. Cryptocurrencies (e.g. ether, bitcoin) underlying decentralized protocols (Ethereum, Bitcoin) are not issued by central institutions. Thus, they are not backed by anything but trust that there will be future demand both for the protocol and its native token. This revenue and payment model avoids potential cryptocurrency volatilities and provides the option to invest into cryptocurrencies.

Carbon credits enjoy also multiple verification systems (i.e. the Gold Standard) aimed at guaranteeing the accountability and quality of the corresponding mitigation actions. The EPC Token generated in energy projects once redeemed is retired and removed from circulation.

For the sale and trading of the EPC tokens, EPC Blockchain Sdn Bhd will work with Carbon Trade Exchange (CTX- GEM) which is the world’s first global electronic exchange for Carbon and a commercial partner for the UNFCCC Clean Development Mechanism registry.

Software as a service for capital raising record keeping

In this model, BESC will be used as a ledger to document energy savings transactions as well as investment transactions. Due diligence will first be carried out by a crowdfunding company in association with a certified energy auditor and measurement and verification professional. Upon the satisfactory completion of the technical and financial due diligence, a dossier with the necessary information will be published and shared with interested investors to allow them to participate in the funding of the project via a crowd funding platform. Investments will be made by investors in cryptocurrency to the participating ESCO and asset owner through the BESC platform to record the transaction and investment quantum. Investment agreements will be drafted to allow the ESCO to make milestone drawdowns upon the implementation of an energy saving project.

Upon the successful implementation of the project, each party’s wallet will be apportioned ES tokens when generated from the energy saving project. Legal documents will be drafted to equate the ES tokens to a fixed fiat amount which allows for the ESCO, BESC, due diligence consultants and investors to subsequently make a claim against the building owner for fiat currency payments. Payments shall be made in accordance to the amount of ES tokens available in each party’s wallet against an agreed fiat currency exchange rate for each ES token.

Once the project is completed and begins to generate energy savings for which invoices can be produced to claim payments from the building owner, EPC tokens will also be generated and distributed among the parties in the project. All parties with the EPC tokens can subsequently decide what they choose to do with the EPC tokens which will be listed on cryptocurrency exchangers. EPC Blockchain Sdn Bhd will receive a commission in the form of ES and EPC tokens for the provision of the smart contracting programming services from the asset owners and will undertake all costs to create records on the blockchain.

- Licensed crowd funding company undertakes the necessary due diligence with a certified energy auditor and measurement and verification professional to produce the necessary prospectus to raise the necessary capital for the projects.

- Secured capital will be channelled directly to ESCOs for equipment purchase

- ESCO uses the capital provided by the investor to purchase the equipment for use by the building owner

- Building owner makes payments from the reduced operational expenditure to all parties with the investor holding seniority with the debt

- Building owner makes any additional payments required to the ESCO, BESC and due diligent consultants

4. MARKET SIZE AND TRENDS

BESC’s strategy is to cover the global market, starting with Malaysia where a patent is pending to protect the venture. The business was started, the product tested, and the service launched in Malaysia where multiple tax incentives are available for start-up funding.

Global outlook

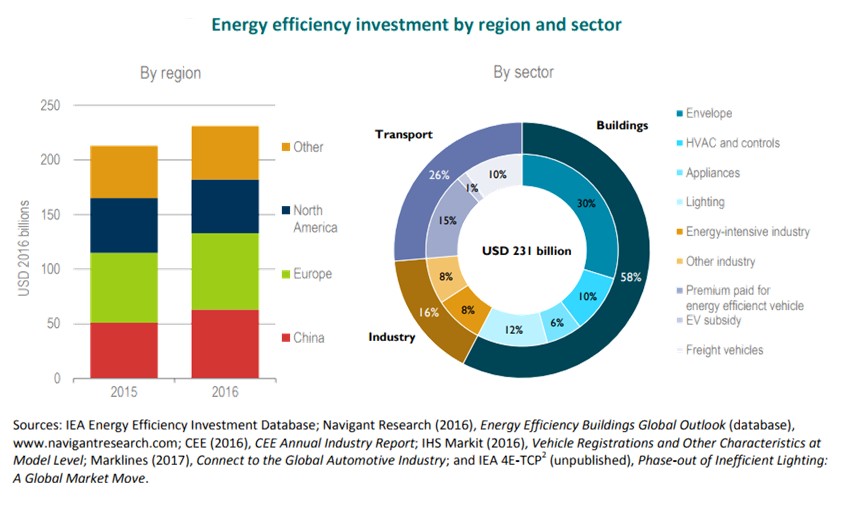

Data from the International Energy Agency estimates that energy efficiency investments globally could reach USD 231 billion. Assuming a cost of USD 1,000 to save 1 ton of carbon credits, there is a potential of 231 million tons of carbon credits to be accumulated from energy efficiency projects.

The BESC is ISEAL compliant and is ideal for the following groups:

INVESTORS FUNDING ‘GREEN’ OR DEVELOPMENT-FOCUSED PROJECTS

National, regional and city governments, impact investors, and traditional investors can use the standard to:

- De-risk their investments as a result of the BESC’s financial, social and environmental safeguards

- Generate accurate, credible energy savings data through robust quantification methodologies (IPMVP) and third-party verification of results

CORPORATES SEEKING CREDIBLE CLAIMS FOR THEIR SUSTAINABILITY INITIATIVES

All companies want to avoid being accused of over claiming or ‘greenwashing’ in their reporting and communications. BESC provides the transparency and credibility to the energy savings. This means purchasers of the EPC tokens can be confident that their programmes – from offsetting and climate finance strategies to sustainable supply chain interventions – follow best practice and that associated metrics and claims are verified by independent third parties.

Enhanced safeguards are in place as all Energy Performance Contract projects would have to adhere to the International Performance Measurement and Verification Protocol to ensure projects deliver real (additional) GHG emissions reductions.

DEVELOPERS OF CLIMATE AND DEVELOPMENT PROJECTS

The robust nature of BESC can make projects more attractive to investors because they are positioned to accurately quantify and record the energy savings and EPC tokens impact profile of an investment. Investors are looking for strong, low-risk projects that can quantify positive environmental and social impact. Corporates are increasingly aligning their sustainability strategies to the Global Goals and are looking for credible ways to report on their contributions.

The possibility to credibly quantify and certify energy savings and EPC tokens impacts makes BESC more attractive to a wide range of funders and buyers of carbon credits.

NATIONAL AND SUB-NATIONAL GOVERNMENTS THAT WANT TO ENSURE CLIMATE ACTION BENEFITS THEIR OWN CONSTITUENTS

By demonstrating that energy saving initiatives also contributes to local development priorities, local governments that uses BESC can gain local stakeholder support for their climate commitments. By providing a range of improvements in quality of life – from reduced air pollution, less waste, and cost savings – efforts to meet the Paris Agreement can actually be popular with constituents.

Malaysia potential

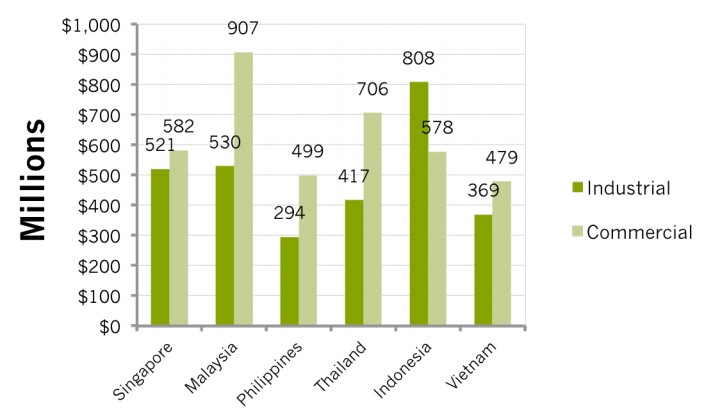

Based on the research report by ReEx Capital Asia in Singapore, the total energy efficiency market size for six South East Asia countries together is about US$6.7 billion where the industrial sector provides an opportunity approximately US$2.9 billion or 44% and the commercial sector providing approximately US$3.7 billion or 56%.

Source: South East Asia Energy Efficiency Market report 2011, ReEx Capital Asia

The Government of Malaysia has also been supportive of the EPC business model and has made the EPC model a key initiative to delivery energy savings in the country . competent IT personnel. Our criteria for the choice of country were based on its potential market structure, legal environment, protection by patent, and other factors

BESC’s goal is to capture up to 40% of the world market and become the #1 name in the minds of EPC developers. With funding and success in patenting the process in Malaysia, BESC anticipates the ability to have captive markets in many countries.

BESC charges project developers, asset owners, investors and its customers a subscription fee for the use of the blockchain. This fee is monetized immediately from monthly payments derived from energy savings (ES tokens) with an additional fee in terms of carbon credits (EPC tokens) which the Energy Performance Contract project generates. BESC’s operational expenses will be supported from the monthly subscription fees collected and will generate additional profit from the sale of EPC credits. As an aggregator for the numerous projects this fee could reach 110,000 tons of EPC credits a year just in Malaysia alone. This could be equivalent to Euro 942,000 a year in revenue . As aggregator, BESC will broker the sale of the EPC credits which could be channelled back to the project originators if sold.

Market Expansion

- Q2 2018: Marketing and patent application in other countries.

- Q2 2018: Tie up with Malaysia Debt Ventures as provider of blockchain services with the loan product

- Q3 2018: Endorsement from Malaysia Government to use BESC as a national reporting tool for EPC or energy savings generated from public sector projects

- Q4 2018: Development of renewable energy blockchain

- 2018-2019: International patent application complete and launch of operations in Australia, Europe, Singapore and Indonesia/Thailand

- Q1 2019: Tie up with suitable party to demonstrate blockchain use to track chemical and waste compliance in accordance to international convention obligations

- By end 2019: Launch of analytics services

- By 2020: Achieving dominance in Asian, US and Europe markets.

- By 2022: Achieving dominance in all active regions. The main means of expanding are running marketing and multilateral fund promotion campaigns to attract international aid monies and ESCO market.

5. SALES AND MARKETING STRATEGIES

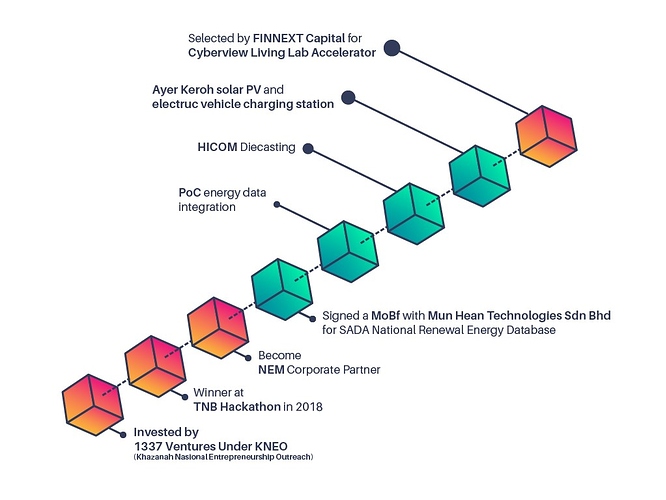

EPC Blockchain Sdn Bhd has a Memorandum of Business exploration with Mun Hean Technologies to jointly develop the Sustainable Energy Development Authority (SEDA) of Malaysia as a potential user of an energy blockchain in the National PV Monitoring and Performance Database that is being constructed by Mun Hean Technologies Sdn Bhd.

BESC’s goal is to capture up to 40% of the world market and become the #1 name in the minds of EPC developers. With funding and success in patenting the process in Malaysia, BESC anticipates the ability to have captive markets in many countries.

BRAND STRATEGY

The goal of BESC is to become a forefront data analytics company leveraging on the benefits of blockchain to compel energy projects to willingly provide the data for analysis. The strategy however is to focus on the ability of blockchain technology to empower the masses to mitigate climate change by providing the ability of the public to invest into energy projects which were once only available to institutional investors.

The branding approach will be one that plays on sustainability and climate change desires to meet consumer needs, emotions, and competitive environments. The messaging across all campaigns will lean towards that while making money is important to almost every business, BESC is willing to achieve more than just profitability. BESC will consistently work towards ways to unlock untapped data resources and revenue for users

6. RESEARCH & DEVELOPMENT (R&D) PLANS

GEOLOCATION-BASED MODEL

All owners of energy savings will be geolocated to ensure that energy savings and future carbon credits can be tracked to the respective countries of origin.

PATENT=PENDING BLOCKCHAIN TECHNOLOGY

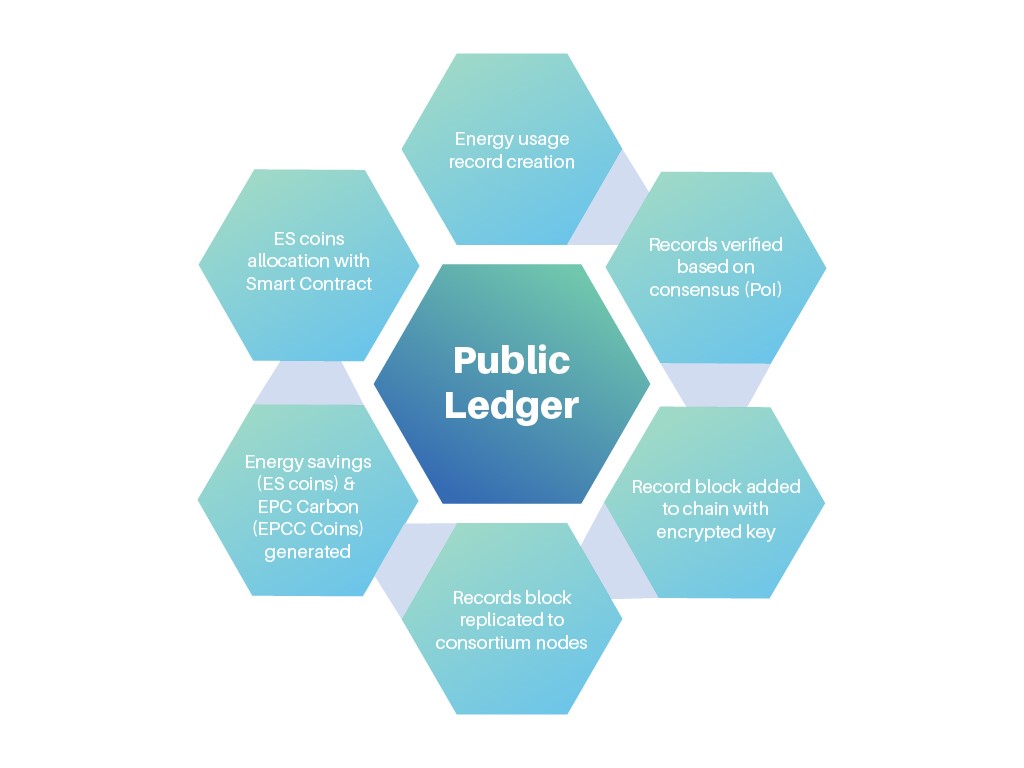

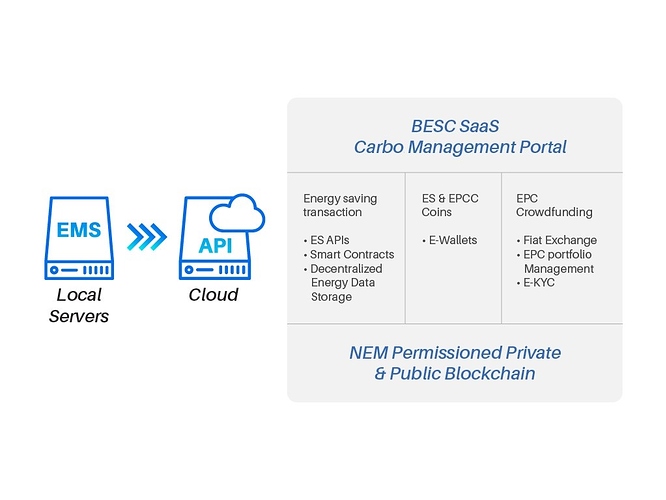

The BESC service uses block chain technology based on Mijin NEM (blockchain as a service). Blockchain makes the company’s energy savings generated from the EPC completely transparent and can stand up to scrutiny of United Nations Framework for Climate Change Convention (UNFCCC) Clean Development Mechanism (CDM) methodologies. The idea proposed is patent pending - MyIPO application no: UL2017001389.

- BESC run on a blockchain as a service (NEM as public blockchain and Mijin as permissioned blockchain)

- EPCC (EPC Carbon) coin use in NEM public blockchain through crypto-currency exchanges with Altcoins as investment.

- ES coin use in MIJIN permissioned blockchain as savings allocation and bought by depositing fiat into E-wallet and destroyed when redeems for fiat currency.

- BESC defined the energy transaction data format and energy saving calculation.

- The energy data is store in distributed IPFS within the private blockchain nodes.

- ESS APIs for energy management system (EMS) to update and access the ES blockchain.

- BESC can be highly scalability and high transaction rates (in excess of 4000 transactions per second).

- Each consortium member will be assigned an E-wallet account to store the ES & EPCC coins and blockchain accessibility.

- ES & EPCC coins are allocated as savings through Smart Contract with commercial agreement among the members.

- The EPC CrowdFunding (ECF) using cryptocurrency crowdfunding model similar to ICO but raise the coins from investors to fund the EPC projects.

- A credit facilitator will be reviewed and manage the fund distribution and repayment collection from investment returns (such as EPC savings).

- The blockchain will use to keep track all the funds distribution and repayments collection.

Technology Roadmap

- Short term (6 months to 1 year)

- Develop PoC project from an existing EPC project for capture the energy savings & CO2 emission data into blockchain.

- Develop ESS Distributed Ledger Management platform (ESS API) for multiple projects integration.

- Develop the EPC CrowdFunding for manage the new project funding

- Medium Term (1 year to 2 years)

- Improve the security of the management platform including data privacy management.

- Develop the automation of energy data measurement and verification system

- Develop the tracking system for carbon credits monetization

- Long Term (beyond 3 years)

- Develop the energy benchmarking system for government

- Build the energy data visualization dashboard and API for third party integration.

- Build the data analytics model for predictive maintenance of energy facilties.

7. CUSTOMERS AND PIPELINE

BESC’s strategy is to cover the global market, starting with Malaysia where a patent is pending to protect the venture. The business was started, the product tested and the service launched in Malaysia where multiple tax incentives are available for startup funding .

To leverage growth, BESC will work with Energy Service Companies (ESCO) to tap on existing projects from ESCOs this will create the user and database for the blockchain and at the same time provide the necessary opportunities to demonstrate the equity crowd funding possibilities for energy efficiency projects.

BESC’s strategy is to work together with Malaysia Debt Ventures (a local government development bank) to use BESC’s block chain as a tool to support the energy performance contracting financing products under its administration. With a fund size of RM 200 million, this would provide BESC’s block chain with the necessary adoption momentum to scale and grow.

The Malaysia Debt Venture, a government backed financial institution in Malaysia has estimated a potential market size of RM 200 million of EPC projects in Malaysia. Based on the developed blockchain project by BESC, the approximate energy saving per capital dollar spent is about RM 0.13 for every 1 kWh a year saved from an EPC. The RM 200 million market potential for capital expenditure could subsequently save approximately 1.5 billion kWh per year or 1.1 million tons of carbon credit per year. According to the Gold Standard organization, energy efficiency projects could fetch approximately Euro 8.2 per ton of carbon credits . This could make the per annum value of the carbon credit to be worth approximately Euro 9.4 million a year.

BESC will also approach SDCL to attract them to use the blockchain. SDCL operates a fund similar to Malaysia Debt Ventures and will be reap the same value from the use of the blockchain.

BESC will be well positioned to meet the needs of the emerging rules of the Paris Agreement and the aviation sector’s new market mechanism CORSIA, as well as broader trends in corporate sustainability and climate and development funding.

8. MILESTONES AND TIMELINE

We are asking for 1,220,000 XEMs or $184,695 USD - The disbursed amount at each milestone is the LOWER of the two.

9. FOUNDING TEAM

The founders are experienced professionals in the energy industry and have implemented a range of energy saving and renewable energy projects. The founders envisioned for the energy blockchain to be a transparent, trusted and auditable energy generation and/or savings scheme & platform that make available for all involved parties. This allows project developers to monetize the untapped commodity of carbon credits generated from energy savings and energy generation projects as well as create an ecosystem that allows for the fundraising of energy projects through alternative models such as equity crowdfunding leveraging on the capabilities of the energy blockchain ledger to document all investment + repayment transactions.

LEONG KAI SING

Industry experience – HVAC and Facilities management

Co-Founder of BESC

• Director of an air conditioning construction company

• Member of the 0.6 kW/RT chiller club

• B.Sc (Hons) Building Services Engineering

• Certified Energy Manager – Malaysia

• Certified Energy Auditor - USA Association of Energy Engineer

Industry experience – Facilities management IoT, Mobile wireless and web applications

CTO and Co-Founder of BESC

• Bachelor degree in Information Technology University of Southern Queensland, Australia.

• Certified Associate in Project Management (CAPM®), PMI

• Executive Data Science Certification, Johns Hopkins University

• Over 20 years of experience in manages mobile wireless solutions & web applications development

• Founded 3 startups range from e-learning portal, mobile marketing platform and facilities maintenance solution.

Advisor & Investor of BESC

Founding partner 1337 Ventures, Malaysia’s first Accelerator programme. He has mentored, developed and invested in over 50 technology start-ups under the 1337 Ventures portfolio in the verticals of gaming, social networking, education, big data, proximity marketing, wearable technology, fintech and recently non-tech and social enterprises.

10. ACHIEVEMENT AND RECOGNITION

• Top 3 Winner of the TNB hackathon in 2018

• Invested by 1337 Ventures under KNEO

• Selected by Finnext Capital for Cyberview Living Lab Accelerator

• Presented Blockchain Energy Savings Consortium (BESC) in International Sustainable Energy Summit (ISES) 2018 forum session

More updates on:

Join our telegram group: https://t.me/joinchat/GIb99Q-oB0_4ZaFshzrUNw