This seems very, very important.

Can you share the example for us, so we can see it with our own eyes?

I believe if nem2 come out at price of 0.50 dollars

bears will dump down after 2 weeks at nem1 price which might be 0.05 dollars

so not good option

Everybody who is in the crypto market for more than 2 years would say that dividing the supply by 10 is a very bad idea and will cause the end of NEM lol

Crypto market doesnt work like this, whale will just stick to the current XEM price or maybe it will be up but not 10 times so we will lose money and the marketcap of the token will decrease and we wont even be in top 30.

By the way, the average crypto newcommer will always buy the cheapest token (thinking it will go to 10k and he will be millionnaire lol) so I dont understand the logic behind trying to increase the price of the token to be more attractive for investisors.

The only way to do it right is to give 1 catapult for 1 xem. All other ideas are terrible.

It’s another extremely bad idea. It decreases a value of current SN owners.

I agree with those who say that token reduction doesn’t make any sense. It’s a dangerous idea with unclear reasons. In a bear market token reduction definitely adds new risks for XEM2 price.

1 XEM2 = 1 XEM. That’s a time-tested solution with clear consequences. On the one hand, Catapult will be a “brand-new solution to change the world so buy it now”, and I don’t see any reasons for token reduction. On the other hand, old NEM will stay a pretty good blockchain for small projects. With 10Y supernode rewards XEM has good chances to stay afloat and reach a high price too.

Sustained. Why standard set of 9 billion XEM’s can’t have a price of ~ $0.30 per token right away? It’s possible, since even XEM NIS1 can do it. There’s some kind of attempt to fight with imaginary conditions. I mean, the idea of reducing the initial offer to maintain the price.

I don’t think 1:10 is a good idea. Only if you can’t promise that with the reduction of coins the cost of a CAT XEM will not decrease, and you certainly won’t promise to do so. Then, in addition to reducing the number of coins by 10 times, we will get an even cheaper CAT XEM.

I would not want such a scenario and as I see most of us are the same side.

Yep, reduction seems to be one of the worst ideas I have heard of.

You’re basically trying to manipulate the market but who would buy it?

NEM is still unknown even for most hard core cryptoheads, but still hold some brand value compared to the Catapult. I would use NEM classic or similar for the old chain and NEM Catapult for the new one.

You guys need keep it simple as possible without any reduction bullcrap.

Reducing supply by a factor of 10 is just a gimmick with no practical use. I’m mostly indifferent to it, as I see it simply a marketing ploy. My biggest concern in that regard would be the divisibility.

My biggest concern overall is that we are going to & have been subsidizing everything, creating insane levels of inflation.

3% inflation in a one time event, just for swapping NEM1 to NEM2. This is a high level of inflation even for major world economies over the course of a year. Yet we are going to do it in a single event, with low liquidity. (2% of max supply = about 3% inflation of circulating supply)

Combining this with subsidies for Foundation, Studios, Ventures, Supernodes, harvesting, paying for exchange listings, or whatever - it’s quite worrisome.

I would be very interested in knowing the projected inflation rate the Catapult committee has.

Also note, the inflation rate is not the percentage of a future maximum supply that is introduced to circulating supply, but is the % increase of the already circulating supply.

In 2019 the majority of cryptos that are showing gains against USD have relatively low inflation rates. And some with great growth actually have deflation - like BNB.

Projects with high inflation, Ripple, Stellar, NEM, and countless others have continued to show steady losses.

Price in and of itself is not the most critical factor. However, it is highly correlated to adoption and interest, especially since we use POS.

The whole point of POS, from an investor standpoint, is defeated when inflation rates exceed adoption & demand.

Price is a #1 factor for those looking to stake or mine any crypto.

Even if I really really really love NEM. It makes little sense to invest so much to host a node. Only people who will host are those who can stand to lose thousands of dollars just to show their support. (Or those who don’t understand the numbers)

Also, businesses building upon NEM have to play hot potato with their XEM - buying small amounts and using them as needed.

There is no incentive to hodl any significant amount to cover network fees, as inflation continues to drive price down, resulting in lost capital. And likewise, there’s no incentive for them to host nodes to benefit their own projects.

We won’t see long term price stability from hype. Hype causes pumps and dumps. We need real adoption and sound economics.

Anyone interested in deeper analysis of other projects, check out https://onchainfx.com/ and https://messari.io These tools are very helpful.

Unfortunately, since NEM has not been transparent and/or communicative enough with 3rd parties, the important information regarding inflation is not available for NEM.

Artificially propping up the price by reducing the supply is something I think dying penny stocks on the stock market do to give the impression that all is well with the project.

Nem has great technology and a worldwide loyal community, if that is not enough for NEM Foundation to make it work and achieve a decent XEM price NEM Foundation has failed, its employees should accept they failed and the project should simply be disbanded and vanish, bow the knee to competitors like Ethereum.

Until then lets hope for some constructive updates that add true value to the project, like NEMgraph, more important partnerships etc.

What do you guys think will happen at the snapshop date for NEM2? Personally I expect some sort of a run-up towards that date, because it’s basically investing in two different platforms for half the price, however after the snapshot date I expect some dump obviously since the offer is no longer valid. (personal opinion, no investment advice)

I’ve been looking into the option too of reducing supply and I too don’t see any practical benefit for reducing supply.

What guarantee is there that the price would trade more after launch with lower supply?

Regarding node subsidies, I don’t know if they are really required either. Instead lower entry requirements for nodes. Dynamic fees would come into play.

While I think that a 10 times higher price will have some positive psychological effects on people who are new to NEM, I think it is a bad idea.

Existing NEM holders will be unpleasantly surprised when they see their new balance on their favorite exchange. They will blog about “the tricks NEM tries to play”. Some holders will sell, because they were holding for technological feat, not for a token who’s first noticeable big change in years is an optical trick. This is not in-game money where the developers decide the price. There is no guarantee that the price will tenfold when the decimal point shifts.

The hassle for exchanges is big, and they will be reluctant to figure out how to adjust all their order books and histories from a certain time onward.

The hassle for holders is big. A claim is a hoop for people to jump through. A snapshot as some kind of block zero for Catapult, where holders don’t have to take action, seems like a better idea to me.

An example of how to do a proper conversion is how Syscoin went from SYS 3 to SYS 4 when Syscoin was rewritten to be the (independently tested) fastest blockchain with 60k+ TPS. Some core developers worked hard with exchanges for a couple of weeks to do the conversion, and to all customers and holders, everything was completely hassle-free because everything stayed the same. (Except ZDAG, 60.000 TPS, and lower fees.)

This is what they are proposing and then launching a new coin (XEM2).

Unfortunately the migration team lacks the technical ability to do a migration like this, so they are instead launching a new coin as their only solution.

I wouldnt call it lack of technical ability, but rather lack of time to implement such a migration. We would be looking at least another 9 month delay, which no one wants.

At the end of the day, I think treating catapult as a new product with a fresh start is a good idea.

Forget all the fancy graphs and computer models whe no one can predict the markets. Alot of it comes down to traders psychology anyway.

Looking at how Ardor went with NXT gives us a good idea and they launched just before the bear market hit and Ardor and NXT are still trading far higher than their pre bull run price.

I still think that the original NEM chain will retain value after catapult launches and when open sourced will have great potential to work alongside catapult as a separate chain with interesting use cases.

There are other blockchains with multi chain models and is not a bad thing.

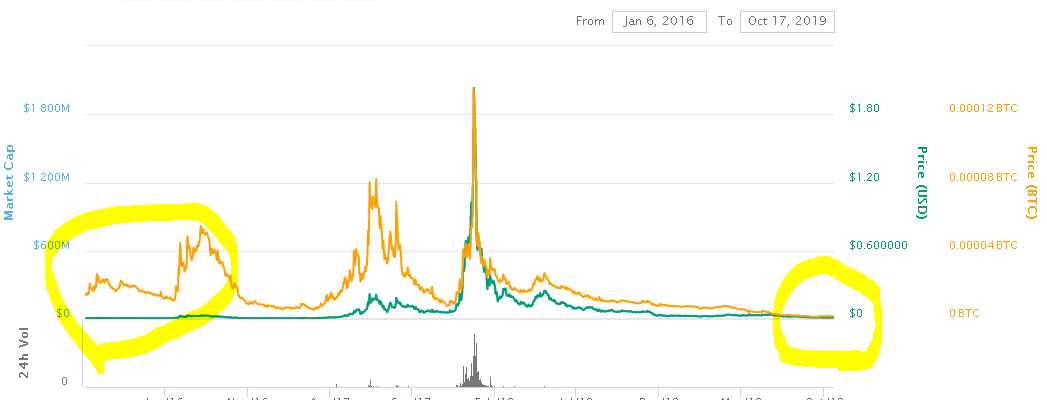

It is a story before the bubble period. Looking at the price(BTC ), it is clearly lowering.

Why do you think you will use an old chain instead of a good chain?

Who will use it? No one will use it. Like a NXT.

I don’t think we can maintain the value for 10 years. After opt-in, the price of XEM drops in an instant.

Can the old NEM chain be Atomic swap with the new NEM chain?

Is there any use for it?

Excuse me. Please tell me because I’m ignorant.

Has the tokenomics agreement ended?

If so, where can I find the conclusion?

If there is still a discussion, on which topic can I see the discussion?

This topic was automatically closed 60 days after the last reply. New replies are no longer allowed.