ABSTRACT

Cryptocurrencies are disruptive and game-changing, but the lack of mainstream adoption has been largely pinned to the price volatility observed in many of these digital currencies.

Disenthral is a financial technology company. It is our vision to simplify financial services, bringing values to everyone everywhere. Our unique selling proposition lies in our ability to build various ecosystems around our proprietary stable coin framework.

Stable coin or a price stable cryptocurrency is our hedge against price volatility. Our crypto-collateralised, stable coin framework is based on elastic coin supply approach, similar to a central bank with Keynesian monetary policy but with a decentralised model.

D.FX is our flagship ecosystem to be built around the stable coin. The restricted, decentralised network is a market-driven product, a collaboration between existing industry players seeking to utilise blockchain technology to scale up a traditional solution. It is our first real-world use case of our stable coin.

The ecosystem brings together a community of global money service operators (MSOs) and money service businesses (MSBs) to create critical mass to resolve FX settlement risk (counter-party risk) and to reduce friction cost. The inclusive peer-to-peer network allows currency to be matched and executed through our liquidity pool system and real-time gross settlement systems.

Links:

Telegram - @d.fx

Proposal - NEM Community Paper

A MESSAGE TO NEM COMMUNITY

We aim to showcase real-world application of NEM blockchain in the world’s largest financial market. This project will merit a successful case study for future commercial projects upon implementation and adoption.

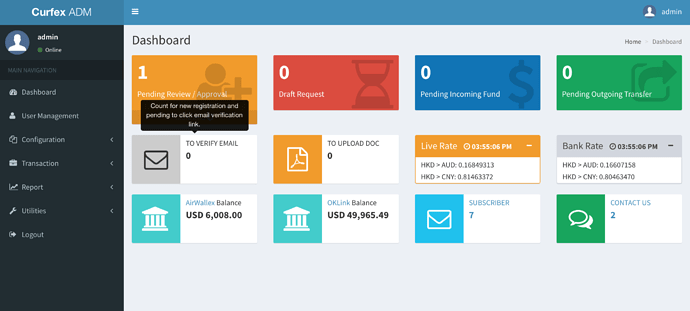

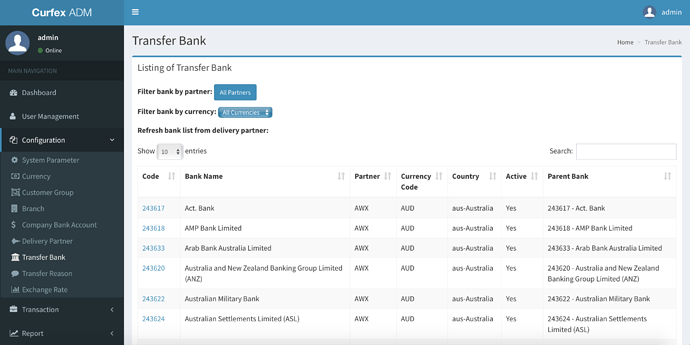

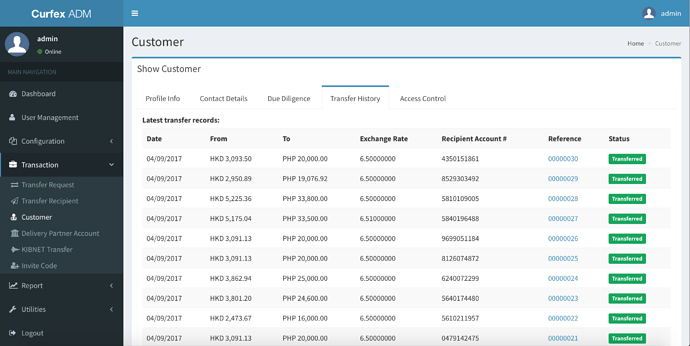

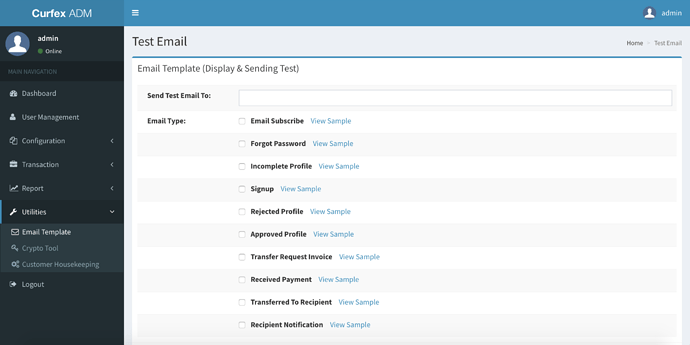

We are seeking the support of the community to develop our D.FX ecosystem on NEM by leveraging on an existing operating business model. The founders have spent over US$300,000 building the current system architecture and an operating FX marketplace.

The existing FX marketplace is the culmination of three years of design, development, test and refinement. The NEM blockchain protocols and stable coin features will transition the marketplace into an ecosystem by adding transparency and trust, in addition to process integrity and reliability.

We intend to roll-out the blockchain-powered solution as soon as it’s ready to our current marketplace. We have identified three partners, prominent industry players with a combined total transaction amount of US$1 billion a year, to be among the early testers of the ecosystem.

Our flagship ecosystem will see immediate access to four markets and six currency pairs when first launch. Further integration with the existing marketplace, together with the necessary refinement works will expand the ecosystem to 12 markets and 66 currency pairs. Finally, strategic tie-ups with identified industry players will bring about global reach for the ecosystem.

We look forward to your support to build this ecosystem together.

PROBLEM STATEMENT

Non-banks (MSOs/MSBs) are increasing their market share in FX transactions – remittance, cross-border personal and business payments.

Traditionally an old economy business, these companies lack the technology sophistication to address settlement risk and friction cost arising from FX transactions. A principle-agent relationship and SWIFT network are among the present archaic solutions but do not address the aforementioned issues efficiently.

There are attempts to adopt blockchain solutions, but current proposals are mostly at infancy with many failing to address price volatility in their tokenomics.

SOLUTION

We aim to address the challenges by building our flagship ecosystem around the FX market on NEM blockchain with the following SMART features:

-

Stable coin

Stable coin is a term used to describe cryptocurrency with stable value feature. Our stable coin framework is based on the elastic coin supply approach, and it is minted and managed by a decentralise autonomous organisation (DAT). Fees generated from theD.FXecosystem is distributed to the minters. The price of the stable coin references a commonly-accepted denominator (e.g. USD) and its value is backed by cryptocurrency. DAT over-collateralises, ensuring total value of the cryptocurrency consistently exceeds the total value of the stable coin in circulation. In addition, DAT expands and contracts the supply of stable coin based on demand, which in turn is driven by FX transaction volume in theD.FXecosystem. -

Marketplace liquidity

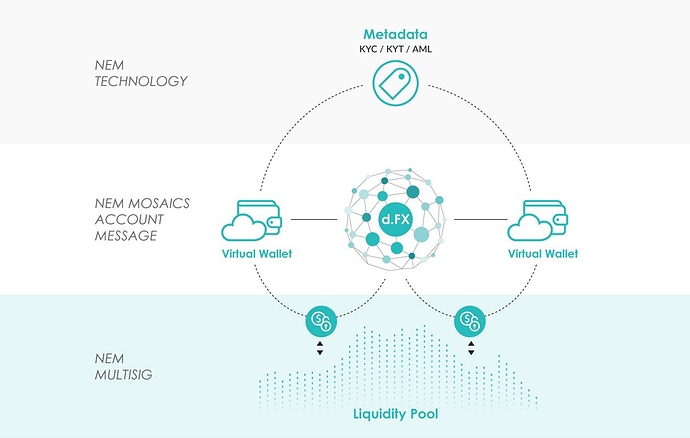

The industry is capital intensive by nature. Scaling up a business requires substantial deposits with financial institutions. Our proprietary liquidity pool framework utilises marketplace liquidity to allow settlement members to scale up their businesses without additional working capital consideration. Marketplace liquidity also addresses friction cost associated to cost of capital. The liquidity pool can be secured using NEM Multisignature. -

Algorithmic price discovery

D.FXbrings together global MSOs/MSBs under a single ecosystem to improve price discovery. Further, a machine learning algorithm will seek out the best FX settlement rate through various cross-rates, lowering friction cost. -

Real-time settlement

D.FXwill complete FX transactions primarily through each country’s respective real-time gross settlement system, eliminating associated settlement risk. Each transaction is also collateral-backed, addressing potential counter party risk. The transfer protocols will be developed using NEM Mosaics, Account and Message. -

Transparency and governance

The network will feature real-time, end-to-end tracking and embedded industry standard KYC/KYT data, giving settlement members full transparency and control over the transaction process. A complete audit trail will also ensure full compliance with regulations. KYC/KYT & AML meta data will be added using NEM Apostille.

BUSINESS MODEL

We monetise and increase XEMs usage through the stable coin that is used across various ecosystems:

Ecosystem 1: D.FX (a business-to-business solution) - current

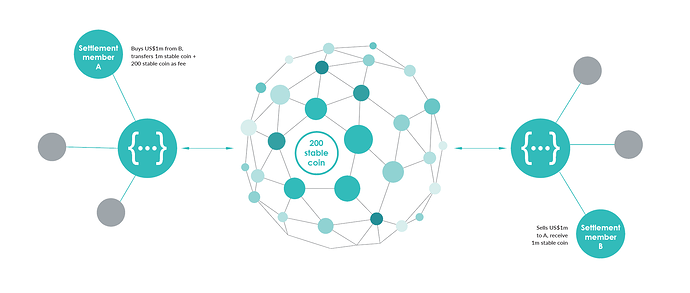

D.FX will capitalise on the significant transaction volume between settlement members. A

fee is charged for each transaction completed in the network.

Proposed fee structure for each transaction : 0.02% of transaction amount

e.g. Settlement member A closes out a US$1 million currency position with Settlement member B. If the stable coin price is US$1.00, Settlement member A will transfer 1,000,000 stable coins to Settlement member B and 200 stable coins (US$1 million * 0.02%) as transaction fee.

The immediate focus of the ecosystem will be on small- to mid-sized MSOs/MSBs handling primarily Asia Pacific remittance and SME FX transactions. Total addressable market in these two segment totalled US$163 billion in 2017.

Ecosystem 2: D.EX (a business-to-customer solution) - future

D.EX is an ecosystem created around crypto exchanges where our stable coin can act as price-stable medium of exchange for cryptocurrencies. At writing, total cryptocurrency market is valued at US$380 billion.

Ecosystem 3: D.POS (a business-to-customer solution) - future

D.POS is a point-of-sale ecosystem. This end-game model hinges on wide adoption of our stable coin through the other various ecosystems. The addressable market covers the entire global retail sales which stood at US$23 trillion last year.

ROADMAP

We are requesting for 1,500,000 XEMs or US$258,000 (US$0.172 per XEM as at 2 July 2018) to be utilised for

D.FX development as follows:

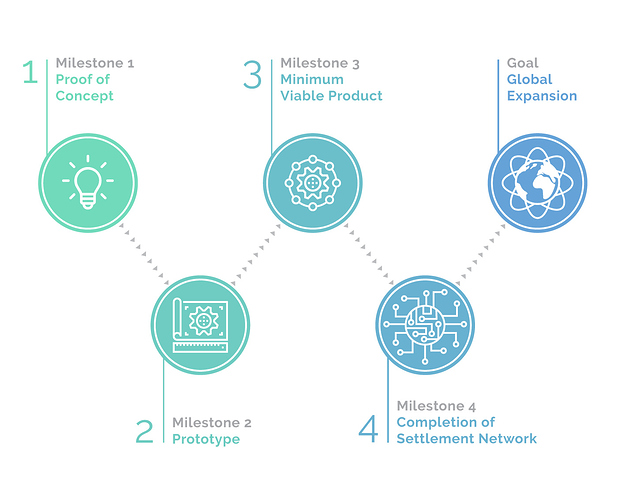

Milestone 1:

10% (150,000 XEMs or US$25,800) to be disbursed upon completion of proof-of-concept stage:

- Engage regional money service operators or money transfer operators to discuss concept of a global ecosystem for FX settlement

- Complete industry and market research, including addressable market size

- Validation of settlement module – operating model, tracking, FX rate queue and sort

- mechanism

- Validation of exchange module - fiat to crypto exchange, virtual account

- Establish compliance framework – reporting, on-boarding and transaction monitoring procedures

- Finalise monetisation model – settlement and exchange fee

- Complete protocol documentation

- Identify initial cybersecurity protocols

Milestone 2:

25% (375,000 XEMs or US$64,500) to be disbursed upon completion of prototype stage:

- Establish FX network architecture based on finalised modules

- Validation of compliance module – reporting, on-boarding and transaction monitoring procedures

- Establish ecosystem’s UI/UX framework

- Develop a User Test Plan for the ecosystem

Milestone 3:

30% (450,000 XEMs or US$77,400) to be disbursed upon completion of MVP stage:

- Establish core functionality of

D.FXecosystem - Develop a User Acceptance test

- Integrate NEM modules to the ecosystem

- Establish security and risk management protocols

Milestone 4:

35% (525,000 XEMs or US$90,300) to be disbursed upon completion of settlement network:

- Complete full functionality of

D.FXecosystem - Full integration with Disenthral’s stable coin architecture

- At least 5 sign-on settlement members, featuring 10 currency pairs

TEAM

LEE Wee Keat

An average Joe Malaysian who resides and works in Hong Kong. Wee Keat brings over 10 years of capital market experience in areas such as mergers and acquisitions, corporate strategy, corporate finance and valuations. He has led deals worth over US$1 billion in his previous capacities at a HK-listed company and a leading regional Asiabank. He is an award-winning financial analyst and a CFA charter holder.

Nicholas LIM

Nicholas brings over 10 years of business management experience in industries such as construction and food & beverage. An Australian graduate with a penchant for new world economy, he has been in the forefront of advocating technology implementation in the old economy.

Ian CHIN

Ian brings over 10 years of experience in sales and finance. His years at IBM, across different business units, taught him that working relationship extends beyond just office formalities. His people person quality is the edge he uses to originate and close deals.

Aaron PARK

An Ivy league graduate with a knack of making things happen. Aaron brings out the best in people and pulls talents together through his network of contacts. He has over 15 years’ experience as an advisor and a consultant in US and Asia.

COLLABORATION WITH NEM

-

Enterprise use case for NEM blockchain

Our flagship ecosystem is built around the FX market. It’s the largest financial market in the world where a system’s integrity and reliability are paramount to a successful adoption. NEM’s solutions are the perfect complementary to the industry, improving on the current standard of security, processing time and risk management. -

Increase demand and transaction volumes for XEMs

D.FXecosystem is powered by NEM blockchain where all transactions will be facilitated by XEMs. Global FX market sees over US$5 trillion transactions a day with our immediate addressable market (cross-border payments and remittance) sitting at US$163 billion a year. -

Advocating NEM goals and vision

In line with NEM’s ethos, we believe in the blockchain’s potential to enhance businesses, particularly in the financial industry. We aim to educate and make available the benefits of this technology across businesses, governments and consumers. -

Regulatory access and acceptance of technology

D.FXecosystem emphasises on compliance and we work closely with regulators, given the nature of the FX industry. The adoption of the technology will be a vote of confidence from a regulatory standpoint, a core missing element in the current cryptocurrency space. Together with NEM, we expect to bring about a stronger adoption of blockchain technology in other regulated industries.

Links:

Telegram - @d.fx

Proposal - NEM Community Paper

Team seems promising.

Team seems promising.