MarginX Community Fund Proposal:

MarginX is a behavioral economics informed incentivization system to reduce resource consumption in situations where other incentives do not exist. It can be applied in many areas that suffer from “The Tragedy of the Commons.” That is, when a resource is available for public consumption with few or no limitations, the resource tends to be consumed to the point of unsustainability. Current cases where the system could be applied are energy, water, waste and city traffic.

The fundamental revolution brought about by bitcoin was to artificially engineer scarcity and provide a digital, peer-to-peer method for transacting it trustlessly and efficiently. Ethereum added a second layer to this system, allowing smart contracts to be written and automatically executed on the blockchain, giving users the freedom to enforce agreements without the need for a central trusted party. While the true revolutionary implications of these two innovations has still not been realized, the industry races to improve on them in trivial ways, or to find ways to use them only to augment existing systems, usually to “cut out the middle man”. MarginX proposes using the distributed ledger to create markets for resources where it was previously impossible and as such we view it as a fundamental innovation for humankind.

On top of this, we are using the latest research in the field of behavioral economics to amplify the outcomes of these new markets. Our first implementation will be in the energy markets, so let me use that as an example to illustrate how the system works.

HOW IT WORKS:

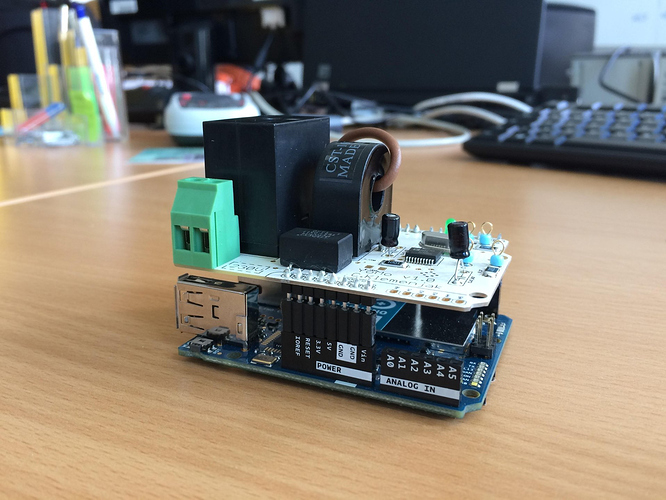

The foundation of the system is the Smart, Pre-Paid energy meter and crypto wallet. We call it the Proof of Conservation Miner, hereafter referred to as the POC Miner, or just Miner. These meters are given to energy utility companies for free for installation in their users’ homes. Users will need to charge them with energy credit before use, either by mobile or with store bought credit, according to regional norms. Energy companies will determine the amount of energy they would like to produce and distribute tokens representing the right to consumption to Miners according to the number of people in the home. This is done on regular intervals and these “Caps” are valid only for the distribution period (ie. when new Caps are distributed, the old ones are invalidated). In order to consume, users must have both sufficient Cap and sufficient credit on their Miner. As they consume both caps and credits are burned. These transactions all take place on a regional private chain.

The Miner will communicate with a central server which will determine, based on historical data of both this user and other users, whether it should be expected that there will be Cap remaining at the beginning of the next distribution period. If this is the case, a Cap sell order will be posted on the Margin Exchange. The exchange will pair this sell order with a buy order from another user, paid for from their energy credit, meaning users can now profit from saving energy. When Miner makes a sale on behalf of the user, the user’s mobile wallet will be credited with XEM tokens, purchased on their behalf by MarginX. The XEM token will be the main currency on the Margin Marketplace.

The YOMO miner, precursor to the POC Miner:

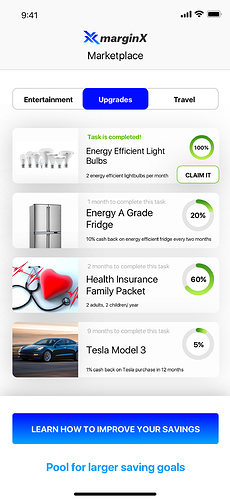

MARGIN MARKETPLACE:

The marketplace is one of two features of the mobile app. This is where users can spend their energy savings and is also where we can amplify the salience of their savings. The marketplace shows users what their savings really mean, more than just the number. Here, users will be presented with items that they can buy with their savings, priced in terms of how long it will take them to obtain them based on their current saving rates. The marketplace is a targeted advertising platform (ie. We can connect users with the suppliers of goods that provide them with the best savings or psychological benefits). Examples of items to be sold on the Marketplace are air-miles, energy efficient appliances, transportation cards, health insurance, vouchers for school books etc. Guidance for reducing consumption will be given by the second feature of the mobile app, the Margin Manager.

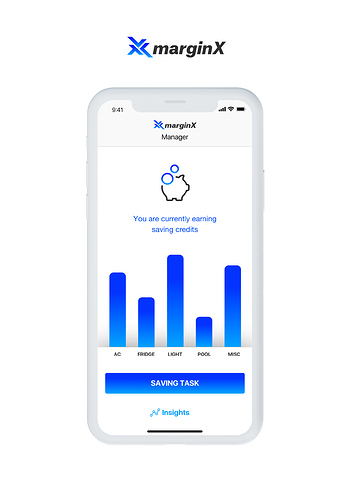

MARGIN MANAGER:

The Margin Manager is where users will see the appliance-by-appliance breakdown of their consumption, as well as be given personal advice on how to reduce it. The Manager will also provide social and psychological incentives to reduce, either by way of a leaderboard, home-to-home comparison, a gamefied levelling-up system or others, again depending on regional tastes.

MARKET ANALYSIS:

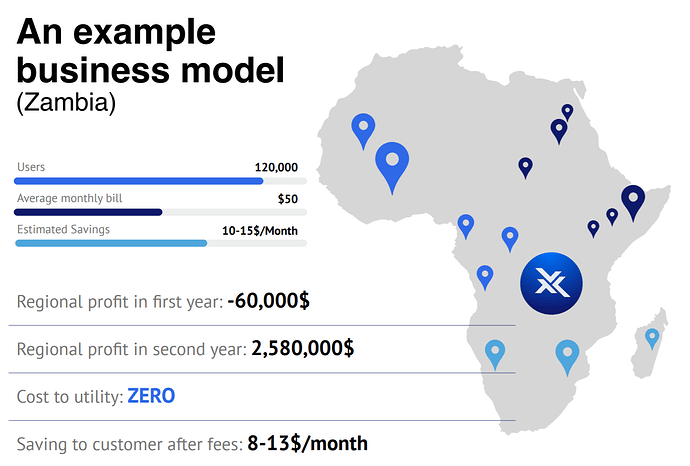

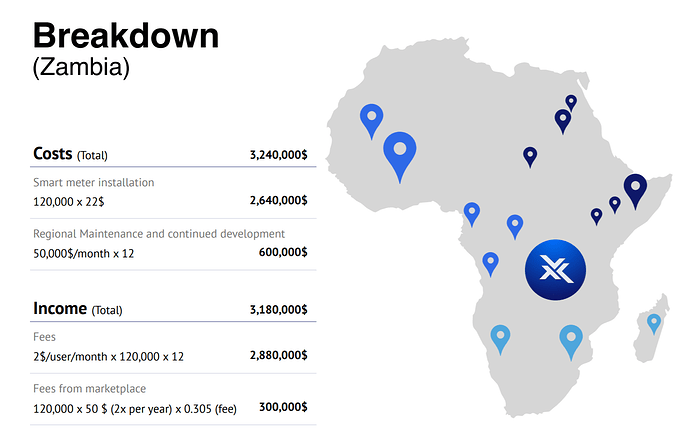

Our initial target market is in developing areas, particularly those that rely heavily on renewable energy. These areas are under the most stress in terms of their energy resources and generally already have Pre-Paid meters installed. Our research indicates that they are desperate for new innovations in this area. As such our tentative initial market base we put at 10-20% of the population of Africa, or about 120-240 million users. This will obviously take significant investment to make into a reality. Current Pre-Paid meters in these areas are not smart and are being sold to utilities for anywhere between 50 and 150$ per unit. We can provide Smart, Pre-Paid meters, with psychological incentives built in, and we can provide them for free.

BUSINESS MODEL

The main revenue for Margin comes from exchange fees from trading of caps. These fees can be as low as $2 per month. Our initial goal is 200,000 users in the first four years. That results in an annual revenue of $4.8 million annually. On top of this we will extract a 5% fee for products bought on the marketplace, estimated to be $0.5 million annually and we will also charge an advertising fee for products listed.

Note: In Zambia, only 120,000 users are connected to the grid, that is 20% of the population. These are almost entirely city people, though not all people in cities are connected. The grid is running at maximum capacity already but, as efficiency improves, more people are getting connected.

WHAT’S IN IT FOR NEM:

- We are offering NEM foundation a share in our company. If we reach our modest fundraising targets, this should be a 3x for the NEM fund within a year, though cashing out at this point will be restricted.

- XEM will be the currency of the Marketplace, driving demand and increasing liquidity for the token.

- Users will save XEM tokens in their mobile wallets until they have enough to make a purchase. This will reduce the circulating supply of XEM tokens. The reduction of supply, coupled with the increased demand from point 2 should increase the scarcity of the token.

- We will develop the Golang SDK for NEM2.

WHY DID WE CHOSE NEM:

- Ease of development and strong support

- Nem Community Fund will allow us to skip ICO completely and instead create a fully tested proof of concept before seeking out venture capital investment. This means that we will be able to choose only the strongest investment funds to invest in our project. Having their weight behind us greatly increases our chances of success.

- Catapult. With the release of Catapult, NEM has become the quiet leader in terms of blockchain features and throughput, the features we intend to use are as follows:

- High-throughput: Using our intelligently engineered system of public and private NEM chains, we can provide our service to more than the entire worlds population with current technology.

- Automatic transaction fee payment: This enables the trading of cap tokens for fiat without the need for a stable coin and provides ease of development of our profit generating mechanism. (This needs more investigation, maybe it is or possible to use like this).

- Decentralized swaps will be used to govern the trading of energy caps and conversion into XEM.

Users may get a notice on their phone. “By turning off your lights from 6-8pm today, you can earn a or b” or some equivalent behavioral psychology enabled statement.

Users may get a notice on their phone. “By turning off your lights from 6-8pm today, you can earn a or b” or some equivalent behavioral psychology enabled statement.