Hey Guys! My name is Jeffery (feel free to connect with me). I’m here to share with you guys a project that I am currently conducting using the NEM Infrastructure!

TLDR : I am using the NEM blockchain to digitize carbon assets that my sustainability-tech company Xarbon has in our reserves. This act of digitizing carbon assets will bring transparency, efficiency, and sustainability to the entire Carbon Economy!

But if you do have the time! Allow me to give you guys a detailed explaining as to what the Carbon Economy Is, and how we will solve the problems within the carbon economy using the NEM database. It’s a bit long, so you might want to grab a snack and a drink.

Global Sustainability Overview

Global warming has had a huge impact on our environment, our community and our health. In the United Nations Framework Convention on Climate Change, the Kyoto Protocol and the framework of the Paris Agreement, atmospheric carbon dioxide emissions have become a scarce and valuable environmental resource for all mankind. We currently emit 36 billion tons of carbon dioxide each year. And only have a quota of 335 billon tons before the earth temperature rises by 2 degrees Celsius on average. (Mooney, 2017) But with an annual carbon emission increase of 2.5% each year, we will break the carbon budget in just 8 years. If we do not take immediate action to reduce emissions, these effects will continue to intensify and become more and more devastating; and the cost of reducing emissions will become increasingly expensive and will affect the entire planet.

Building a low-carbon economy is the key to combating global warming. An important step was taken globally in 2017. In response to global climate change, the nearly 200 counties of the UNFCCC unanimously agreed to adopt the long-term goal of the Paris Agreement, which has been concretely defined as "Temperature rise controlled to within 2℃”. (World Resource Institute, 2017) To achieve this common goal, carbon markets are being implemented in various countries. China started a nationwide carbon market on 18 December, 2017, with a target carbon price of 200-300 Chinese Yuan RMB. (Energy Innovation: Policy and Technology, 2017) Uninterrupted international negotiations have taken place in various countries and regions and some achievements have been made with regards to having individual nations commit to an upper limit to their carbon dioxide emissions.

Carbon Markets Overview

Carbon Trading is a market mechanism that The United Nations Framework Convention on Climate Change (UNFCCC) adopted on 9 May 1992. This mechanism incentivizes the reduction of global greenhouse gas emissions by giving a handful of state backed entities the ability to commoditize and place a monetary value on each metric ton of Carbon Dioxide emitted in their respective jurisdictions. These assets that represent one ton of Carbon Dioxide emissions are generally called “Carbon Credits” or “Carbon Units”.

Companies that have accounts with the United Nations can “raise” Carbon Units from the UN in exchange for conducting various project around the world that reduce carbon emission. These projects can range all the way from protecting rainforests from degradation, to researching and developing new factory carbon scrubs. For each ton of Carbon Dioxide removed from the atmosphere, these project teams can receive one carbon unit.

In return for the sustainability work conducted by these project teams. They can sell their carbon unit on the secondary market to fund continuous sustainability work. Usually these carbon units are sold to either 1.) Polluting companies, companies that have a legal obligation to purchase carbon credits due to their excessive carbon dioxide emissions. Or 2.) Companies that wish to engage in corporate social responsibility, as this gives them large tax breaks and deductions.

Currently Issues Within the Carbon Market

To date, the carbon market has two major problems in terms of transparency and efficiency. The transparency problem exists because once the carbon units are issues to the projects teams. Transactions on the secondary and tertiary market are poorly documented through solely paperwork. This results in fraudulent situation where one carbon unit is being sold to several different parties. Or where non-existent carbon units are being sold to unsuspecting consumers. Obviously, this is not how carbon units are intended to work, as one carbon unit can only allow one party to emit one metric ton of carbon dioxide. And due to this lack of transparency, any transaction within the carbon markets involve large amounts of due diligence, paperwork, and legal fees which can at times add a 30% inefficiency to the cost of purchasing carbon units. (Carbon Pulse, 2018)

The inefficiency and lack of transparency in the carbon markets have also resulted in the fracturing of individual markets, and general lack of liquidity for carbon assets. Due to this, carbon units can have a drastically different market value in different regions that often does not reflect the true environmental costs of the pollution.

As established above, the process of conducting transactions within the carbon markets is a difficult and cumbersome one, often packed with paperwork, legal work, and due diligence. This has resulted in only resourceful corporations being involved with carbon trading while individuals are being left out. Individuals around the world are increasingly aware of the seriousness of climate change, but their efforts with various kinds of charitable activities are far from adequate. If through some mechanism, individuals themselves can easily partake within the carbon markets, their impact on total carbon dioxide reductions could be significant.

Xarbon Sustainability Limited - General Overview of Company

Xarbon Sustainability Limited (Hereafter referred to as “XSL”) is a sustainability technology company that is registered in Seychelles and is governed by the laws of Seychelles. XSL’s core management team constitute of members that control one of the two dozen afore-mentioned account with the United Nations. This account allows us to propose forestry projects to the UNFCCC for various carbon reduction units.

Our sustainability work currently constitutes of protecting various areas of the Papua New Guinea rainforest from any forms of degradation. Since rainforest operate like carbon sinks (a natural reservoir that accumulates and stores some carbon-containing chemical compound for an indefinite period), XSL has already received up to 200 million carbon unit futures from this project, with an upper limit of 1 billion registerable carbon dioxide. XSL is actively seeking additional projects that can yield the company more registerable carbon reductions.

Usually, this registerable carbon can be sold to the afore mentioned institutional consumers through a paperwork sale. However, XSL is now using a public, transparent, and tamper proof distributed database to issue this digitalized registerable carbon. For each ton of registerable carbon dioxide reductions that XSL holds in our company reserve, we will issue a single digitized unit called Xarbon. Xarbon, being digitized on this open database, will make the transactions within the carbon market fully transparent, and allow companies and individuals to much more easily conduct transactions within the carbon markets.

XSL’s business model is simple. We obtain registerable carbon from conducting various sustainability projects throughout the globe. And XSL generates revenue by selling the digitized version of our registerable carbon reserves.

Over 50% of the revenue generated by XSL are spend on the prevention of rainforest degradation, and the research and development of more efficient carbon scrubbers. The remainder of the capital is used for operational expenses. XSL is a sustainability technology company that is truly self-sustainable from a business perspective.

Digitizing Registerable Carbon

XSL digitizes our registerable carbon reductions by leveraging an open software platform called the “New Economy Movement” (Hereafter referred to as “NEM”). NEM is an open and decentralized information system that is built upon a blockchain architecture to maintain it transparent and tamper proof properties. The properties of being tamper proof and fully transparent, make NEM an ideal platform for XSL to issue our asset backed Xarbon on.

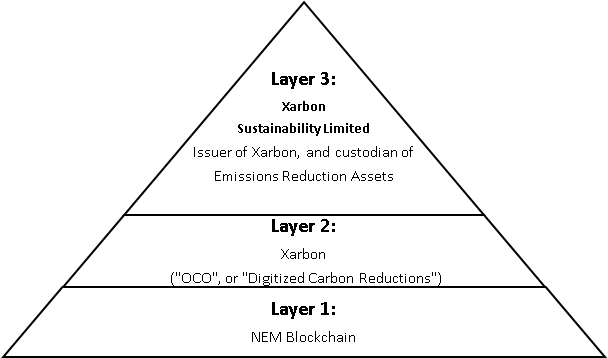

Xarbon’s technical stack constitutes of three layers illustrated below.

The Three Layers

The First Layer – NEM

The first layer of our technology requires any transparent database with a tamper proof history. Our team chose the NEM blockchain for this specific purpose due to NEM’s ability to easily allow XSL to issue, re-issue, and destroy Xarbon depending on the carbon reduction reserves in XSL’s holdings. The NEM blockchain also makes the integration of Xarbon very simple for any third party that wishes to utilize Xarbon in their system.

The Second Layer – Xarbon

The second layer constitutes of Xarbon, the digitized carbon reductions that XSL issues. There are many benefits that a digitized carbon asset provides compared to its physical counterpart, which is usually in the form of paper certificates.

Firstly, Xarbon’s digitized nature brings full transparency into the carbon trading markets where ownership, ownership amount, and transaction history are fully transparent to anyone with access to internet by observing the public NEM blockchain. This will effectively make fraudulent transactions (where fake carbon emissions are sold, or where a single carbon emission is being sold to multiple parties) within the carbon markets impossible.

Secondly, Xarbon’s digitized nature makes the costs of conducting a transaction of carbon emissions tantamount to near zero. This is partially due to the fully transparent nature of Xarbon (meaning parties no longer require as extensive due diligence), and because the inefficiency of paperwork and legal work is now no longer required for each transaction of registerable carbon. Instead, users can now easily conduct these transactions from the comfort of their internet connected laptops.

Finally, a digitized form of carbon reductions allows for the divisibility of a single unit of carbon into smaller decimal units. This allows for various innovative approaches to creating a negative carbon economy that will be covered later in more detail.

The Third Layer – Xarbon Sustainability Limited

The third layer constitutes of our company Xarbon Sustainability Limited (“XSL”). XSL is responsible for preserving and holding the physical registerable carbon within our company reserves. Consumers that wish to exchange Xarbon for the physical registerable carbon certificates within our reserves can always do so subject to administration costs.

XSL will be audited by a global and reputable accountancy firm at least once a year to prove the solvency of the registerable carbon within our reserves. And depending on the results of the audit report, XSL will re-issue, or destroy Xarbon to assure each Xarbon in circulation is backed at least 1-to-1 with 1 ton of registerable carbon dioxide.

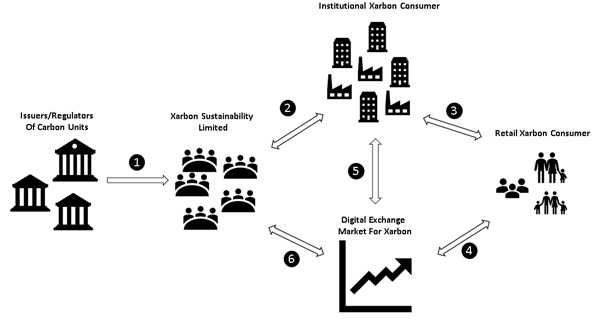

Xarbon OCO Ecosystem - Diagram Overview

Above is a diagram representation of the Xarbon ecosystem, and below is an explanation of who the stakeholders within the Xarbon ecosystem are. The relationships between the stakeholders are represented with numbered points on the above diagram and will also be explained below.

Point 1 – Issuers & Xarbon Sustainability Limited

Point 1 represent the relationship between the UNFCCC, and various other governmental bodies that are capable of issuing carbon instruments (Carbon Credits, Emissions Reductions, Certified Reductions, etc…) and Xarbon Sustainability Limited (XSL).

As stated before, XSL hold one of the few accounts with the United Nations Framework Convention for Climate Change that allows XSL to propose registerable carbon projects in return for carbon credits. Once XSL has obtained additional registerable carbon from our sustainability projects around the world, XSL will digitize these emission reductions through our open and transparent technology into digitized carbon reductions, Xarbon.

Point 2 – Xarbon Sustainability Limited & Institutional Consumers

Point 2 represents the relationship between XSL and various institutional consumers of Xarbon. This relationship is one where XSL sells our digitized carbon reductions, Xarbon to our institutional buyers. Institutions generally purchase carbon reductions for two reasons, the first kind of institutional consumers are companies that are polluters. These polluter companies have an annual limit on how many tons of carbon dioxide they can emit into the atmosphere, and if this emission amount is surpassed, they are forced to purchase carbon emission reductions, or face heavy environmental fines by their local authorities.

The second kind of institutional consumers are companies that wish to partake in corporate social responsibility activities. These institutions purchase these carbon reductions so that they can reap the marketing, branding, public relations, and or tax benefits of having done so.

Historically, the transaction of conventional carbon units involved papers work, legal work, and at times long periods of due diligence. This is due to the lack of transparency within the conventional carbon markets. However, as explained in this document, Xarbon being the digitized version of registerable carbon reductions, allows us to circumvent the traditional sale model by simply transacting Xarbon among XSL and our institutional consumers digitally. This makes transacting Xarbon 30% more efficient compared to conventional carbon reductions.

Point 3 – Institutional Consumer & Retails Consumers

Point 3 represents the relationship between institutional Xarbon consumers and retail Xarbon consumers. This relationship might not initially seem self-explanatory. However, this relationship exists even without Xarbon, the digitized form of registerable carbon. It’s just that Xarbon makes this relationship a lot more efficient, transparent, and gives the retail consumers a means to actually own the registerable carbon themselves through a digitized medium.

Historically, institutions who have purchased registerable carbon as part of their corporate social responsibility, were able to communicate their good deed of purchasing this carbon reduction to their own retail consumers through various marketing or branding methods. For example, XYZ company that bought 5 million tonnes of carbon dioxide reductions, would put on their product packaging in text “In making of this product, XYZ company reduced carbon dioxide emissions by 5 million tonnes in 2016”. And retail consumers could consciously decide to purchase goods from companies who have done this. Thus, indirectly offsetting carbon emission.

Due to the lack of transparency within the emissions reduction markets, retail consumers had historically no easy means of verifying the companies’ claims of having purchased carbon reductions. However, with the rise of Xarbon, this is no longer the case. Due to Xarbon’s digitized nature, institutions are now able to “put” fractions of a unit of registerable carbon into each of their product units. An easy way to achieve this is by simply giving their retail customers a QR code which would allow the customer to claim the fractions of a carbon unit for themselves.

This mechanism of allowing retail consumers to “claim” their Xarbon from products they have purchased, using their computers or mobile phones, is the basis for creating a multitude of negative carbon products. By purchasing these negative carbon products, retail consumers can consciously influence how many tonnes of carbon dioxide is reduced form the atmosphere by either directly purchasing Xarbon, or by purchasing negative carbon products which have a set amount of Xarbon within them.

Xarbon Sustainability Limited is currently in the process of working with various e-commerce platforms and manufacturing companies to integrate Xarbon into the products that their merchants are selling. This is all made possible by Xarbon’s digital, transparent, and efficient nature. Allowing retail consumers to consciously affect how much carbon dioxide gets released into the atmosphere.

Point 4, 5, 6 – Digital Exchange & Market Stakeholders

Point 4, 5, and 6 represents the relationship between the digital exchanges and the various stakeholders within the Xarbon ecosystem. These Xarbon exchanges are digital platforms on which all stakeholders who own Xarbon, can buy and sell Xarbon on an open marketing using digital currencies, assets and conventional currencies.

XSL is currently in talks with various online digital platforms that allow for such transactions to take place. And XSL will also actively work on building our own Xarbon exchange that allows for permission less, and transparent exchange of Xarbon and various digital assets.

More Information About Xarbon

If you’ve made it this far! Then thank you so much for taking the time to learn about the carbon economy, and our mission to increase the transparency, efficiency, and liquidity within it.

Our team can broadly constitute of 1.) Tech People, and 2.) Carbon Traders. Which means, that we have the knowledge, expertise, and relationships to obtain carbon assets, and to digitize them using NEM. However, we are currently looking for people around the world who are willing to help us with Marketing, Business Development, and Funding. So if you’re interested in helping us out, please send me a DM on Linkedin or directly on this forum! I’ll get back to you within 24 hours!

Also I would hugely appreciate any commentary, or questions you might have for me in this thread.

I hope we can keep in touch:

Website: www.xarbon.com

Twitter: https://twitter.com/XarbonOCO

Telegram Group: https://t.me/XarbonOCO

Linkedin: https://www.linkedin.com/company/xarbon/

My Personal Linkedin: https://www.linkedin.com/in/jefferyxunliu/

Facebook: https://www.facebook.com/xarbon/

AIRDROPS!: https://medium.com/@XarbonOCO/xarbon-oco-bounty-program-64585ec2da45