Hi Greg,

Interesting project.

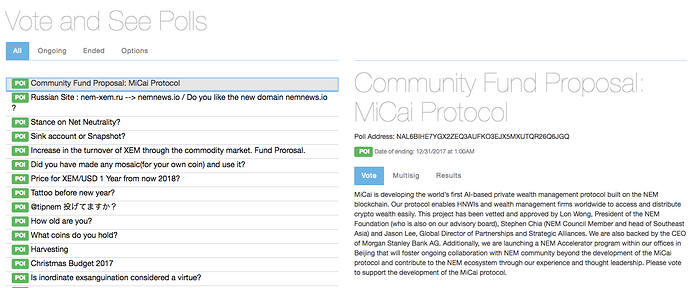

I read the proposal last night and although I really like the sound of MiCai and would love to have it built on the NEM platform, I was pretty critical about parts of the proposal.

Like some others I am confused by the ‘NEM Investment Fund’. It appears you are taking $8million from the ‘NEM Community Fund’ and then re-allocating it instantly to this ‘NEM Investment Fund’. However looking through your description of the ‘NEM Investment Fund’ -

• 30% to other wealth management innovators to "encourage" blockchain adoption, and the possibility of it being NEM based.

• 30% to your business partners that integrate into your product.

• 30% to improve "your" customers experience with "your" product.

• 10% to push brand awareness for NEM AND MiCai <<<<< Is this the entire accelerator budget?

This doesn’t really look like a NEM Investment Fund to me, and I still don’t understand why we should remove funds from one investment fund that the community has control over to this fund which appears to be not so great. The benefit to the NEM community is tenuous.

Regarding the accelerator I mentioned above (I’m not sure if that is where the budget for it comes from). The NEM Foundation is here to support the NEM ecosystem so I’m not sure why removing funds from the community fund for you to do the same is a good idea.

Maybe you can explain this? Why you think you can do it better, or what you can offer the NEM Foundation cannot etc.

Similar to others in this thread I also have an issue with the amount of XEM that is being requested by MiCai and if the community fund is best spent on projects similar to yours.

You are requesting a very large sum of money yet the VAST majority of the upside is with MiCai and its investors. You will receive possibly tens of millions of dollars from the NEM community to build a private company that if it becomes successful will make you and your investors a lot of money.

The NEM community which it looks like will contribute the majority of the funding will not receive any of the profits you generate, yet it will take the most risk. Your VC and individual investors have raised $5million which could easily be 10x less than the funding you receive from the NEM community yet they will no doubt receive a nice profit share for a much smaller risk.

There is a benefit to having you build on the NEM platform for the NEM community, but I don’t believe it is enough to justify the amount of XEM being requested. I again stress most of the upside belongs you to and your investors and a much smaller amount to the community, while most of the risk is taken by the NEM community.

We as a community also need to remember there is a big benefit for this company to build on the NEM platform already, it is an amazing platform. It is one they have identified they want to build their product on. Lets remember as a community we do not need to give away our funding cheaply to the companies making these proposals as they already want to work on our blockchain.… let us drive the BEST deal we can for NEM.

This leads me to give my opinion on how we as a community should handle the community fund. It is my belief that we should try to push for companies to repay their loans in full once they become profitable. This allows us to sustain the community fund and have a more balanced deal which benefits the NEM community and the company requesting funding equally.

They receive a large interest free loan which they only begin to repay once they are in profit. If they fail, they do not have to repay the loan - This is a pretty damn good deal.

The NEM community has the receiver of the loan build their product on the NEM platform, has the loan repaid in full, receives no excess profit but benefits due to adoption.

If the company fails the NEM community takes the hit - This is still more beneficial to the company than the NEM community in my opinion but it is much closer than the deal MiCai has proposed.

As the proposal stands I will be voting NO, but I would still like to see MiCai pursue building on the NEM platform and would be happily open to considering a revised proposal.

Ben Gee.

As a footnote - After seeing Charlie Lee sell and donate all Litecoins to remove any conflict of interest he may have, I wonder if it would be in best practice to not have those who are vetting the proposals also be equity investors in the company.

I trust Lon, Jeff, Stephen and Jason however it does seem like it may be in best practice to not have those who are invested in the company also vetting it. Something to think about.

this guy gets it

this guy gets it