1)Product Information:

The below provides a draft to explain more about our product, the problems it solves, the solutions it provides and how we use the NEM blockchain:

1. EXECUTIVE SUMMARY

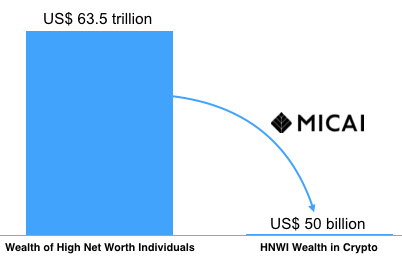

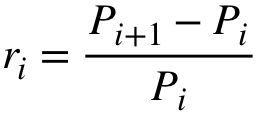

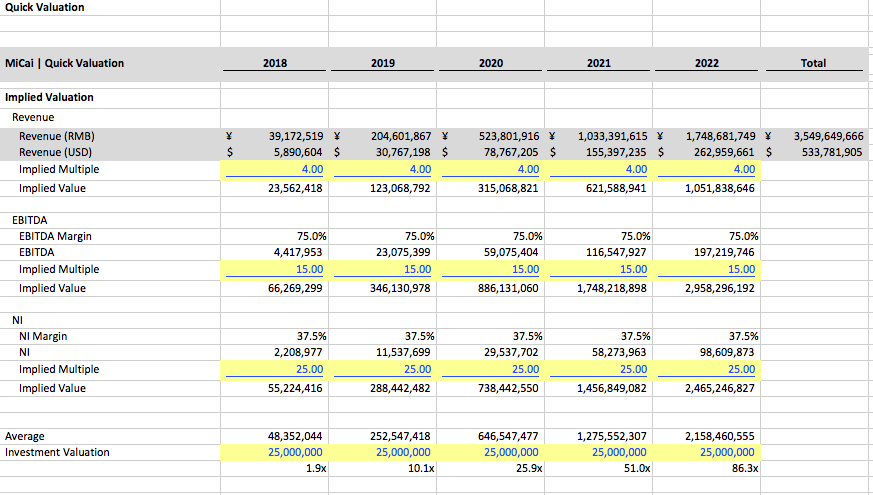

Globally, High Net Worth Individuals (HNWIs) have a combined wealth worth USD 63.5 trillion. However, the market cap of crypto wealth within this same group of individuals is only a small fraction of their combined wealth at USD 50 billion. This represents a significant market opportunity.

This proportionally low investment in crypto is not because these HNWIs don’t want to invest in crypto assets, in fact, this demographic of individuals are well known to be the first adopters of new asset classes and developments in fintech. There continues to be growing interest and demand for this asset class from HNWIs, as the broader community comes to grips with what crypto means for the future of financial markets across the globe. The problem for HNWIs wanting to invest in crypto assets actually lies with the existing private wealth management systems that facilitate their investments. These antiquated systems cannot support HNWIs and their advisors to easily leverage the potential of crypto investments.

To solve this problem, MiCai is introducing the world’s first Artificial Intelligence (AI) based crypto wealth management platform built on the NEM blockchain. With proven success launching ground breaking wealth management projects, MiCai aims to be the catalyst for providing HNWIs and wealth management firms worldwide access to crypto, and enabling them to transform traditional assets into digital assets.

Within this whitepaper we delve into more detail about the three main components of the MiCai protocol—functions, modules, engines—and what the development of this technology means for the investors in our business through our MIC token, and the future of crypto wealth management.

2. THE OPPORTUNITY

Currently, the wealth of HNWIs is worth USD 63.5 trillion globally[1]. However, the market cap for HNWIs crypto wealth is only a small fragment of this at USD 50 billion. Chinese HNWIs in particular contribute to USD 10 trillion of this global wealth[2], with less than USD 10 billion invested in crypto assets. It is a well-documented fact that these HNWIs*, and the wealth management firms servicing them, are early adopters of new technologies and asset classes given the greater amount of risk capital that they can deploy.

In traditional markets, HNWIs are willing to bet on higher-risk, high-return ideas through investments in Private Equity, Venture Capital (VC) and other alternative investments. However, such investments are generally illiquid, locking up funds for an average of five to ten years. Investors also cannot simply sell their stake when they want to without potentially facing high losses. For HNWIs, and any investor for that matter, liquidity—being able to enter, exit and convert any tradable asset—is very important.

The birth of cryptocurrencies as a tradable asset has seen vast shift of investment from traditional assets to digital ones, as a result of increased investor interest outside of the US, particularly in China, South Korea and Japan. By 2025, the World Economic Forum predicts that 10% of global GDP will be stored via Crypto[3]. However, it’s not just monetary value that crypto brings to the financial market, in fact, that is the tip of the iceberg.

Crypto enables the development of other tradable digital assets. If a HNWI invests in a crypto asset it means that they own a portion of the technology that the asset represents, and their ownership allows them to access the benefits of it. Investing in crypto enables investors to manage their existing liquid wealth but also facilitates the collateralization of underlying assets such as art and real-estate, to transform these into liquid assets as well. Traditional assets don’t offer such benefits to their investors, and this why HNWIs are keen to leverage crypto technology to transform their wealth portfolio.

3. THE PROBLEM

Despite being an attractive new asset class, there are some key challenges that HNWIs and private wealth management firms face at the prospect of investing in crypto. These specific issues are:

-

Difficult Access to, and Diversification of Crypto

Like any evolving financial market, crypto it requires a robust and compliant platform to enable investors to trade between different assets easily. Currently, no such platform provides access to crypto, allows existing assets to be tokenized into digital assets, enables investors to borrow crypto or trade their tokenized assets for different ones.

-

Privacy and Data Breaches

In order for investors to use the services of a wealth management firm or to buy investment products, they need to expose their personal information for verification. IBM conducted a study and found that more than 200 million financial services records were breached throughout 2016[4]. This startling amount of breaches were mostly caused by human error; which is biggest vulnerability of financial service firms. Cyber criminals target this weak spot, and it’s as simple as one individual worker being hit with multiple phishing scams to install malware on their work computer.

-

Costly Product Distribution

Distribution in private wealth management is still a very manual, high touch, and highly costly process. According to our own research,over USD 5 billion is spent annually on distribution in China. Each fund has its own Investor Relationship department that meets face-to-face with numerous investment product procurement departments. Once a product has been chosen, there is much due diligence around admin, approvals and training before the product is packaged for relationship managers to recommend to their clients. It can be a very long and costly process.

-

High Compliance Costs

Around 25% of a private wealth management firm’s costs results from compliance and security. New regulatory requirements will continue to drive these costs up, with an average increase of about 9% annually[5], and is expected to drain more than 10% of revenue in the next five years[6]. Firms also spend large amounts on regulatory fines due to human errors during the compliance process, as many of these processes are completed manually. Banks have been fined a staggering USD 321 billion since the start of the 2008 financial crisis[7]. Deutsche Bank alone was fined USD 650 million in 2017 for compliance failures in their client onboarding procedures[8].

-

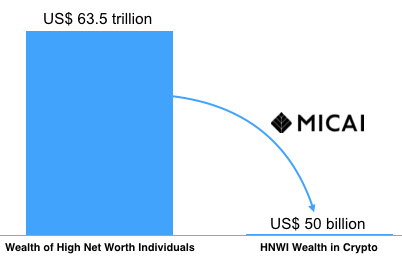

Lack of Reporting Standards and Consistent Data Management

Most investors have portfolios of products that are held by different custodians, each with their own way of reporting. This can cause data disaggregation, and result in investors not understanding the underlying risk of various asset portfolios; one of the key reasons behind the 2008 financial crisis. Custodians have varying, often changing, methods to report critical data about an investment product, such as value, performance and fees. Lack of a uniform reporting standards challenges asset managers, wealth management firms and clients to understand what their holdings are at any point in time, how to allocate their assets, and the associated risks of their investments. As a consequence, portfolio analysis can take lengthy amounts of time, and investment decisions are based on incomplete data, which exposes investors to unwanted increase of risk.

The reason why these problems exist are a result of the antiquated financial systems that HNWIs—and the private wealth management firms advising them—rely on to manage their investments. Current wealth management platforms lack the ability to enable the acquisition and flow of crypto assets easily.

Financial institutions that serve HNWIs operate in a very fragmented market. This makes them heavily reliant on third parties for technology infrastructure. These centralized and outdated, mostly excel based systems provide an unreliable backbone for financial transactions to occur with no clear accountability for operators in with the financial ecosystem, despite heavy industry regulations.

If we look back to the 2008 financial crisis, which has estimated to have cost the global economy in excess of USD 22 trillion[9], we see a perfect example of how financial systems can fail us. Reasons for the crisis included inadequate or no transparency of who owned what, what product had what underlying it, the risk of each asset, and no uniform ledger of wealth management on which the risk was made visible to investors. Little has changed since then. Ironically, despite the crisis, the financial industry still relies on the same financial systems that existed back then; technology that is not equipped to deal with this modern era of digital investing.

4. THE SOLUTION

At MiCai we are pursuing this market opportunity, and tackling its associated challenges, by developing the world’s first AI driven crypto wealth management platform, powered by NEM blockchain technology. Our protocol is centred around building a robust, regulatory compliant platform that enables HNWIs to achieve liquidity and access to the crypto investment environment. We enable HNWIs to convert traditional wealth into digital assets, facilitate crypto loans, and provide a platform to trade these digital assets globally.

The MiCai protocol is an open-source, Application Programming Interface (API) built on the NEM blockchain, and incorporates the entire ecosystem for private wealth management. We see blockchain technologies and AI as a better, and indeed necessary, foundation for modern financial systems upon which HNWIs will rely on to diversify their wealth into crypto.

The MiCai protocol creates a transparent ecosystem for private wealth management. We will leverage our own industry expertise and proprietary technology to build the platform alongside other entities we will partner with. This will enable us to establish global standards and innovation leadership alongside blockchain based custodians such as Melonport, or blockchain based origination firms such as Nivaura. Regulators will also be able to deploy their latest regulations directly onto the MiCai protocol at any time so that our platform will always be compliant ready for our clients.

The MiCai protocol is comprised of three main components:

-

Modules which enable the creation and flow of crypto assets,

-

Functions which establish the foundation and global standard of all transactions that occur within the protocol, and

-

Engines powered by Artificial Intelligence (AI) that provide data to enable HNWIs and their advisors to make smart, well-informed investment decisions.

MiCai Apollo is the operating system used to access the MiCai protocol. Features of this operating system are already in use at several private wealth management firms worldwide through our existing operations in China and Europe. HNWIs, their advisors and financial services firms will be able to access the MiCai protocol through Apollo, or through other third party front-end interfaces that are built on top of the MiCai protocol.

In order to use our protocol users will have to acquire our MIC token which will provide them access and usage rights. For more information about the economics of our token, please read the following section entitled: Our MIC Token. In addition to this, in order to prevent abuse of the platform, MiCai will initially only allow users to join who:

- Have a verified wallet

- Are clients who either directly use our services or have private wealth managers that manage their wealth using our existing software

- Have funds on a custodian that reports on our system

- Can be verified by some identity attesters we trust

5. MICAI MODULES

Our protocol Modules are transactional tools which investors will use to have better access to crypto and be able to diversify their assets. In addition to this, funds are able to distribute their products to market in a cost-effective and simple way. This part of our platform is where our clients will have the majority of their day-to-day interactions with the protocol. MiCai will generate revenue from B2C and B2B customers by charging a fee to initiate transactions through our protocol. The three modules are: mTokenize, mLoan and mMarket.

5.1 mTokenize

The mTokenize module allows clients to easily tokenize their assets to create Collateralized Assets. Collateralized Assets are assets which gain their value from real-world assets. For example, a digital asset that is backed by a commodity is DGX from Digix[10], which binds the value of gold to a digital asset. We will also cooperate with other tokenization providers to enable users to tokenize their assets and access all their collateralized assets within our platform.

5.2 mLoan

mLoan allows borrowing against the user’s assets. A smart contract will hold the title deed and serve as collateral. The smart contract will issue our MIC tokens to the borrower’s wallet for the amount borrowed, and the owner of the tokens will receive their interest earned in MIC tokens. For example, a family office owning farmland wants to borrow crypto against the land. The family office can establish a smart contract over the title deed of their land on the NEM blockchain. In case of non-repayment, this contract switches the ownership from the family office to the issuer of the loan. This module is extremely attractive for users as it encourages the use of traditional wealth to leverage crypto investments without having to dispose of assets. Furthermore, the interest that is charged on the loan can be one of the lowest in the market because the loan is collateralized unlike most traditional loans. This allows us to become a very competitive player in the market. Through our API we will open up mLoan to other third party loan providers to underwrite asset-backed loans using smart contracts.

5.3 mMarket

mMarket is a compliant global marketplace where product providers such as funds and asset-based tokens can distribute and sell their products to investors and private wealth management companies using our platform.

The mMarket module allows products to be easily distributed in a way that satisfies both the jurisdiction of the custodian as well as the jurisdiction of the client in a way that is cost-effective, efficient and compliant. For example, if a resident of Singapore buys an asset in Japan, we make sure the right KYC is being done for the Singaporean investor, and the right compliance is being followed according to the Japanese regulator. It will also be a secondary market for traditional market funds such as Private Equity and VC, which will enable us to not only attract experienced crypto investors onto our platform, but also traditional investors too.

Through mMarket users will be able to trade the following assets:

-

Collateralized Assets: Users will have access to assets that have been tokenized through mTokenize, as well as those that have been tokenized by other approved tokenization partners. The tokenization will create a large secondary market for primary funds such as Private Equity and VC. The excess liquidity will increase the value of this asset class by 10-20%[12].

-

Crypto Funds: Will be distribute their funds on our platform provided they have passed our compliance check.

-

Crypto Fixed Income Products: these will be fixed income products that could have been issued via mLoan or other third party providers

-

Funds with NEM Blockchain Based Custodians: These can be used to distribute funds onto our platform.

-

Traditional Funds: Such as Private Equity, VC, Hedge Funds and Wealth Management, will be able to be distributed on mMarket after approval.

6. MICAI FUNCTIONS

Our protocol Functions are the backbone of our platform. They address the current challenges in privacy, data protection, compliance costs and reporting standards, by creating automated and more robust processes that link directly to custodians.

6.1 mReport

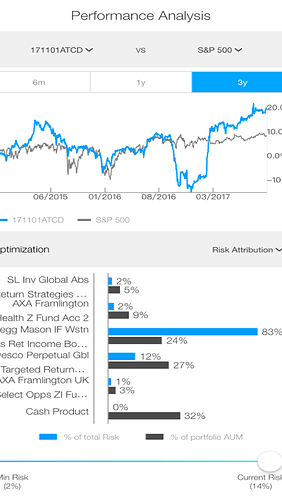

Our reporting and performance tracking function, mReport, links different custodians for each user directly into our protocol to unify reporting of key portfolio data. Our system will report and track current and historical data that is tied to a financial product’s performance and fees, and enable user to compare products.

Through blockchain technology we have designed a way to deliver consistent reporting of performance history for traditional investment products, as well as new crypto-based products that we will support. The data of mReport is updated in real-time, immediately accessible by investors and funds, who have complete discretion of what third parties they wish to share the information with. Users can also export reporting data based on data points which are most relevant for the recipient of the report.

Consistency issues such as date formatting, reporting of fees and differences in NAV calculations that make it hard to undertake performance comparisons are also resolved under the mReport function.

6.2 mID

A crucial part of executing financial transactions is the “Know Your Customer” (KYC) verification process to ensure each client’s personal and/or corporate identity is adequately established. Some products also require additional verification including: minimum requirement of assets, anti-money laundering, business licenses and other compliance related checks to enable a client to invest in a particular product within their risk parameters.

mID creates a globally secure user identity, allowing investors to have their wealth managed by third parties, invest in products or receive financial advice, without having to disclose sensitive personal information. mID allows organizations that store information about individual identities or source of funds to attest to the identity of a MiCai protocol user and earmark that information on the blockchain for future use.

These organizations play a critical role in helping to onboard users onto the mID system as identity attesters. They do this by providing their public keys with a description of the data they need in order to complete their attestation, such as ‘name’, ‘date of birth’, ‘address’, ‘ID number’ and ‘articles of association’. The user then attaches their identity information encrypted for each identity attester respectively, using their own public keys. The attesters then evaluate the information returned to them by the user and publish on the blockchain whether they have satisfied their requirements. If the user does not pass the verification we can facilitate contact with data vendors to update records.

By publishing all historical identity attestations on the blockchain, we are building a secure, reusable user identity that develops trust over time rather than having to be re-evaluated for every transaction with a new distribution company or fund management company. This will save significant money across the network of distribution companies and fund management companies who would normally have to carry out verification processes for every new customer or transaction. For investors, it will help to significantly reduce their on-boarding time by reducing duplicate work conducted by anti-fraud and compliance teams across organizations. For example, if a client with private wealth management firm A has completed the KYC process, and wants private wealth management firm B (with similar KYC process) to manage a part of the same user’s wealth, the user will not have to complete another KYC process in order to set this up.

mID will support:

-

Document Verification such as a passport or a driver’s license to confirm whether the image of the person on the document matches the user submitting the scan of the document; or in the case of an entity the submission of the articles of incorporation

-

ID Verification by cross-checking supplied information with several databases, public records and government records

-

Social Verification by verifying the identity information of users via social networks like Facebook, WeChat and Weibo to reduce fraud

-

Blacklist Screening to ensure that a user is not on one of the many global sanction programs operated by various governments around the world

-

Politically Exposed Persons to ensure that a user is not considered to be a politically exposed person (someone with a prominent political function who is at high risk of potential bribery or corruption involvement).

6.3 mRisk

mRisk is the standardized metric of risk scoring for an asset’s risk. This decentralized score is similar to Standard & Poor’s rating of debt, and Morningstar’s rating of funds. This protocol function securely exposes the risk of financial products to enable asset managers, wealth managers, regulators and investors have a clear view of the risk in the system.

The initial mRisk score will be calculated based on the past performance and volatility data points found in mReport. As our platform grows over time we expect to increase the sophistication of the score based on what usage best predicts outcomes. We will continue to improve this scoring mechanism through ongoing research and feedback from participants in the ecosystem.

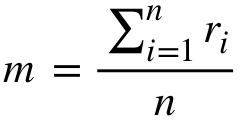

Scoring Component 1: Performance

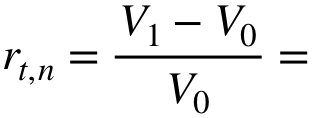

mRisk defines return as the gain or loss on an investment over a specified time period.

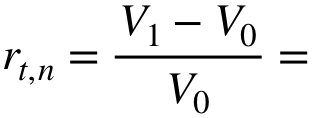

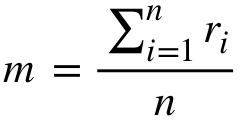

mRisk calculates an asset’s return as Point-to-Point return in the following way:

Where:

the total return for sub-period t,n

= the full fair value of the portfolio, including cash and accrued income, at the end of the period

= the full fair value of the portfolio, including cash and accrued income, at the end of the period

= the full fair value of the portfolio, including cash and accrued income, at the beginning of the period

= the full fair value of the portfolio, including cash and accrued income, at the beginning of the period

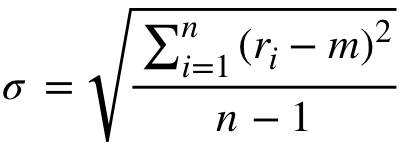

Scoring Component 2: Historical Volatility

mRisk defines historical volatility as the realized volatility of a financial instrument over a given period of time.

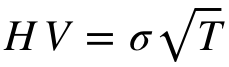

mRisk calculates historical volatility in the following manner:

where:

HV = Historical Volatility

= standard deviation

= standard deviation

T = number (count) of periods in a year

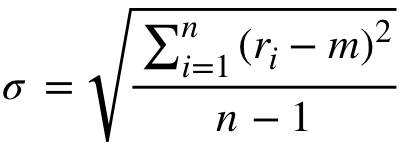

where:

= price returns

= price returns

m = mean (average) of all data points

n = number of data points

where:

mean(average) of all data points

price returns is calculated using:

Percentage of price change

7. MICAI ENGINES

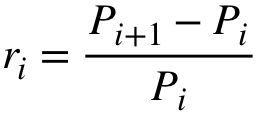

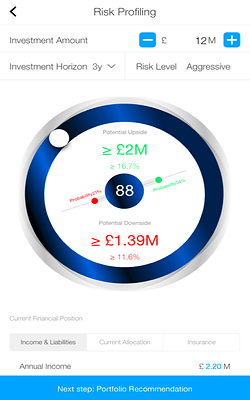

MiCai has developed smart engines that pull in data from the protocol functions (mReport, mID and mRisk) and utilizes state of the art machine learning—based on aggregate data stored in the MiCai protocol—to analyze and automate part of the duties performed at wealth management firms. Through its current operations MiCai has already developed three engines: Financial Planning, Portfolio and Risk.

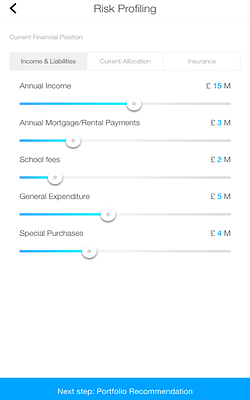

7.1 Financial Planning Engine

Our Financial Planning engine allows private wealth management companies to create financial plans and portfolios individualized to the profile and needs of their clients. We use artificial intelligence and data from mID, mReport and mRisk to make sure the right products are recommended to the right investors. The engine automatically updates with the client’s latest information and product recommendations from mMarket.

7.2 Portfolio Engine

The Portfolio engine allows investor portfolios to be managed manually, or to be automated by clients and/or the wealth management firms that advise them. It provides the main analytics of the client’s portfolio, calculated from mReport. Automated portfolio management happens through our proprietary Robo Advisory technology given a certain set of parameters. As the first Robo Advisor in China we have the experience and tools already in place to integrate this into our developing protocol. This engine can also link with the API of dealing systems to execute the trades automatically, reducing cost of manual execution and minimizing the risk of manual errors.

7.3 Risk Engine

Our Risk engine constantly monitors risk and stress tests the portfolio of the end client. It takes into account the mRisk score of assets and calculates a series of risk metrics.

The first set of metrics are static such as VaR (Value at Risk). The engine will also calculate and stress test several scenarios. For example, financial market scenarios such as “what will happen to my client’s portfolios if the bitcoin price drops by 10%, or what happens to my portfolio if the price of USD vs RMB drops by 5%?” can be answered through this engine.

Deeper scenario analysis can also be conducted by the protocol to order to answer more complex financial questions involving other economic factors, for example “what effect will there be on asset classes if there is a war with North Korea?”. mRisk and mReport will give a basis of clean data upon which these AI engines can deliver their analysis. We provide an open API to access our data so other risk management providers can utilize MiCai’s protocol for their own use.

References:

[1] https://www.reuters.com/article/us-global-wealth/millionaires-wealth-reached-record-63-5-trillion-globally-in-2016-study-idUSKCN1C30L2

[2] http://www.chinadaily.com.cn/business/2017-06/21/content_29830916.htm

[3] http://www3.weforum.org/docs/WEF_GAC15_Technological_Tipping_Points_report_2015.pdf

[4] http://www.businessinsider.com/bank-data-breaches-are-up-and-its-an-insider-job-2017-5/?r=AU&IR=T

[5] http://www.wealthmanagement.com/regulation-compliance/advisors-paying-more-compliance

[6] https://www.fnlondon.com/articles/compliance-costs-to-more-than-double-by-2022-survey-finds-20170427

[7] https://www.bloomberg.com/news/articles/2017-03-02/world-s-biggest-banks-fined-321-billion-since-financial-crisis

[8] https://www.db.com/newsroom_news/2017/medien/deutsche-bank-reaches-settlements-over-russian-securities-trades-en-11460.htm

[9] http://www.gao.gov/products/GAO-13-180

[10] https://digix.global/dgd/

[11] https://makerdao.com/

[12] https://www.ft.com/content/f0b88608-73b3-11e5-bdb1-e6e4767162cc

but I do appreciate that you have taken the time to provide constructive feedback.

but I do appreciate that you have taken the time to provide constructive feedback.